Advance Invoice Tax Directorate - Use autoinvoice to create prepayment invoices for advance payments from customers against transactions originating from third party or. Through our secure online portal, you can: Why do businesses use advance invoicing? 10k+ visitors in the past month Browse through information on personal and real property taxes, county revenue, and vehicle license decals. Mandatory information, vat & input tax: Pay business, personal property, or real estate taxes. Learn how to properly issue and manage advance payment invoicing, including tax requirements and compliance, in our latest guide for self. Loudoun county collects personal property.

Pay business, personal property, or real estate taxes. Loudoun county collects personal property. Browse through information on personal and real property taxes, county revenue, and vehicle license decals. Why do businesses use advance invoicing? Through our secure online portal, you can: Use autoinvoice to create prepayment invoices for advance payments from customers against transactions originating from third party or. 10k+ visitors in the past month Learn how to properly issue and manage advance payment invoicing, including tax requirements and compliance, in our latest guide for self. Mandatory information, vat & input tax:

Loudoun county collects personal property. Mandatory information, vat & input tax: Through our secure online portal, you can: Use autoinvoice to create prepayment invoices for advance payments from customers against transactions originating from third party or. Learn how to properly issue and manage advance payment invoicing, including tax requirements and compliance, in our latest guide for self. 10k+ visitors in the past month Why do businesses use advance invoicing? Pay business, personal property, or real estate taxes. Browse through information on personal and real property taxes, county revenue, and vehicle license decals.

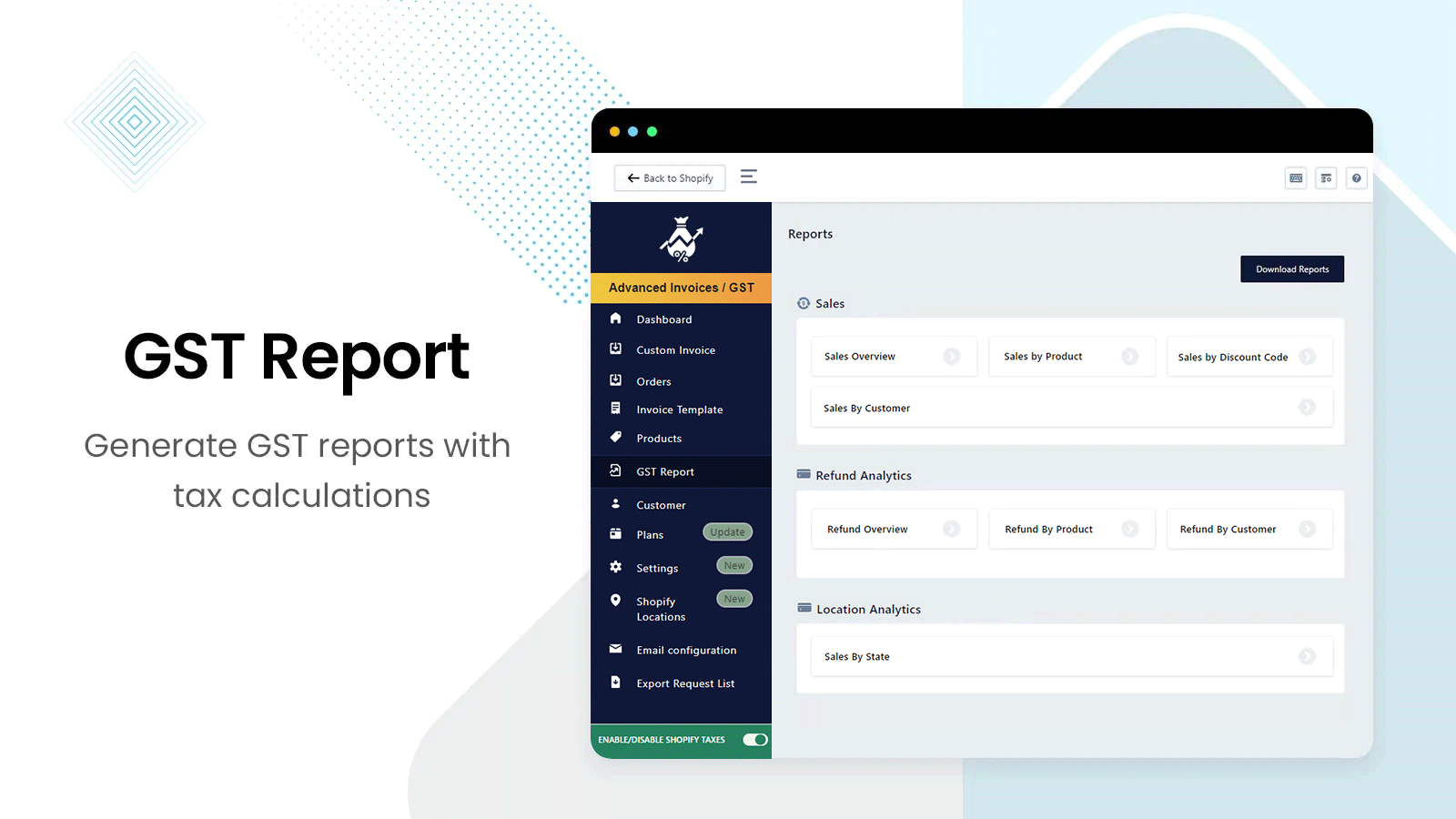

Advanced Invoices/GST App Automatic invoices with global tax settings

Mandatory information, vat & input tax: Pay business, personal property, or real estate taxes. 10k+ visitors in the past month Through our secure online portal, you can: Why do businesses use advance invoicing?

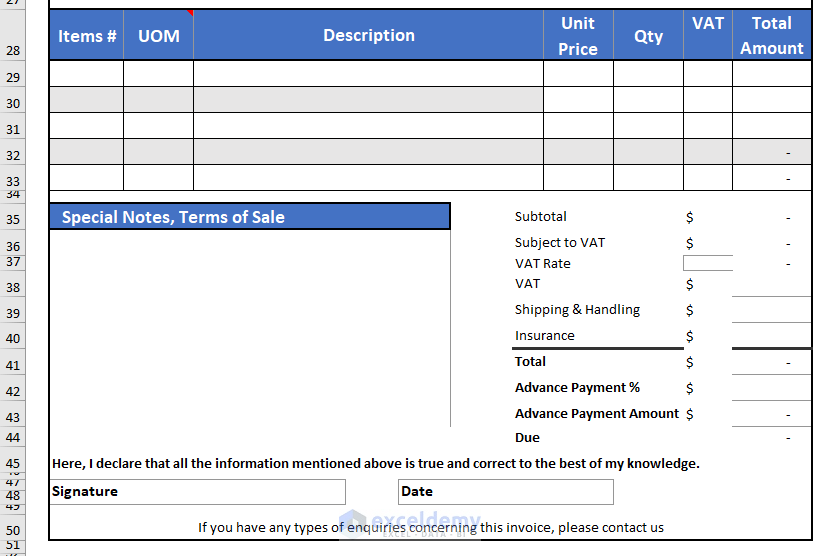

Create Accurate Advance Payment Proforma Invoices with Excel A

Mandatory information, vat & input tax: 10k+ visitors in the past month Loudoun county collects personal property. Browse through information on personal and real property taxes, county revenue, and vehicle license decals. Why do businesses use advance invoicing?

Advance Tax Invoice Template Free Excel Templates

Through our secure online portal, you can: 10k+ visitors in the past month Pay business, personal property, or real estate taxes. Mandatory information, vat & input tax: Why do businesses use advance invoicing?

Advance Invoice Meaning, Pros & Cons

Browse through information on personal and real property taxes, county revenue, and vehicle license decals. Why do businesses use advance invoicing? 10k+ visitors in the past month Loudoun county collects personal property. Learn how to properly issue and manage advance payment invoicing, including tax requirements and compliance, in our latest guide for self.

What is an advance invoice schedule and how to create one? Chargebee

Pay business, personal property, or real estate taxes. Use autoinvoice to create prepayment invoices for advance payments from customers against transactions originating from third party or. Why do businesses use advance invoicing? Mandatory information, vat & input tax: Loudoun county collects personal property.

How to Create Proforma Invoice for Advance Payment in Excel

Browse through information on personal and real property taxes, county revenue, and vehicle license decals. Why do businesses use advance invoicing? Pay business, personal property, or real estate taxes. Through our secure online portal, you can: Mandatory information, vat & input tax:

What is Receipt Voucher in GST GST Invoice Format

Mandatory information, vat & input tax: Pay business, personal property, or real estate taxes. Through our secure online portal, you can: Browse through information on personal and real property taxes, county revenue, and vehicle license decals. Use autoinvoice to create prepayment invoices for advance payments from customers against transactions originating from third party or.

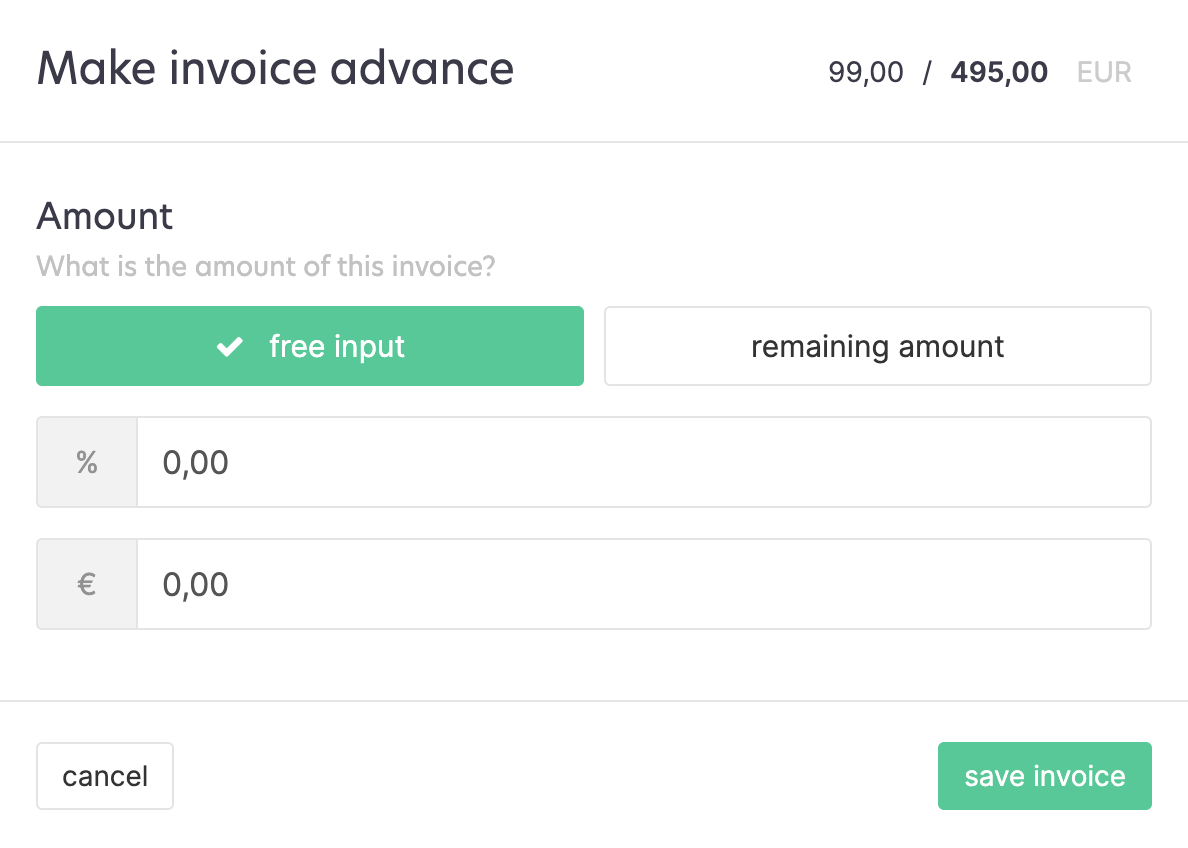

Creating an advance invoice View an example

Use autoinvoice to create prepayment invoices for advance payments from customers against transactions originating from third party or. 10k+ visitors in the past month Loudoun county collects personal property. Browse through information on personal and real property taxes, county revenue, and vehicle license decals. Mandatory information, vat & input tax:

Infor LN 10.4 Invoicing Advance Invoicing Enhancements ppt video

Learn how to properly issue and manage advance payment invoicing, including tax requirements and compliance, in our latest guide for self. 10k+ visitors in the past month Browse through information on personal and real property taxes, county revenue, and vehicle license decals. Mandatory information, vat & input tax: Why do businesses use advance invoicing?

Advance Invoice QAS PDF Value Added Tax Invoice

Why do businesses use advance invoicing? Pay business, personal property, or real estate taxes. Browse through information on personal and real property taxes, county revenue, and vehicle license decals. 10k+ visitors in the past month Learn how to properly issue and manage advance payment invoicing, including tax requirements and compliance, in our latest guide for self.

Browse Through Information On Personal And Real Property Taxes, County Revenue, And Vehicle License Decals.

Loudoun county collects personal property. Through our secure online portal, you can: Learn how to properly issue and manage advance payment invoicing, including tax requirements and compliance, in our latest guide for self. Why do businesses use advance invoicing?

10K+ Visitors In The Past Month

Pay business, personal property, or real estate taxes. Mandatory information, vat & input tax: Use autoinvoice to create prepayment invoices for advance payments from customers against transactions originating from third party or.