Deductions On A Payslip - Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your. Understanding your employees’ net pay requires a clear grasp of payroll deductions and withholdings.

Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your. Understanding your employees’ net pay requires a clear grasp of payroll deductions and withholdings.

Understanding your employees’ net pay requires a clear grasp of payroll deductions and withholdings. Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your.

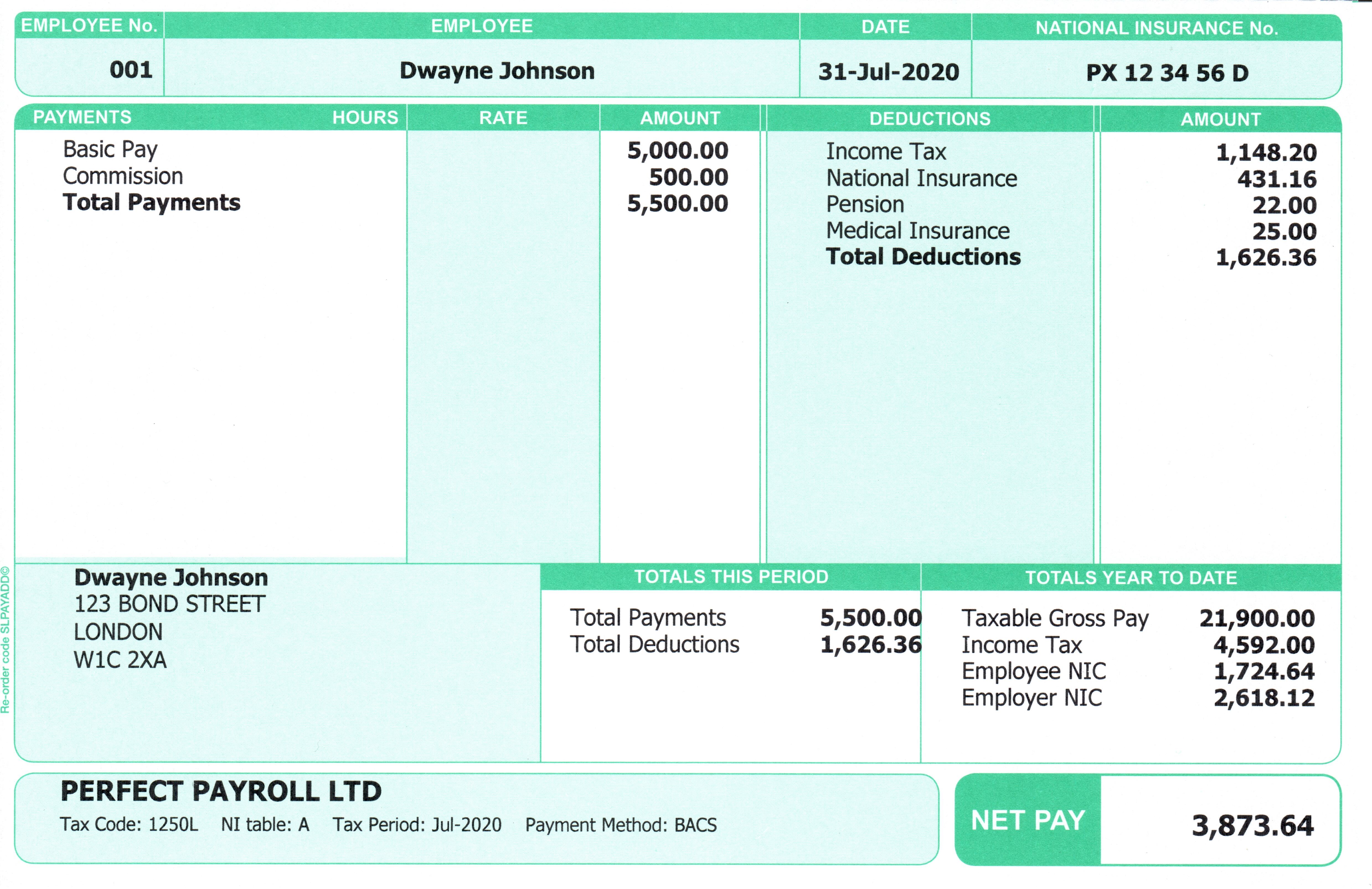

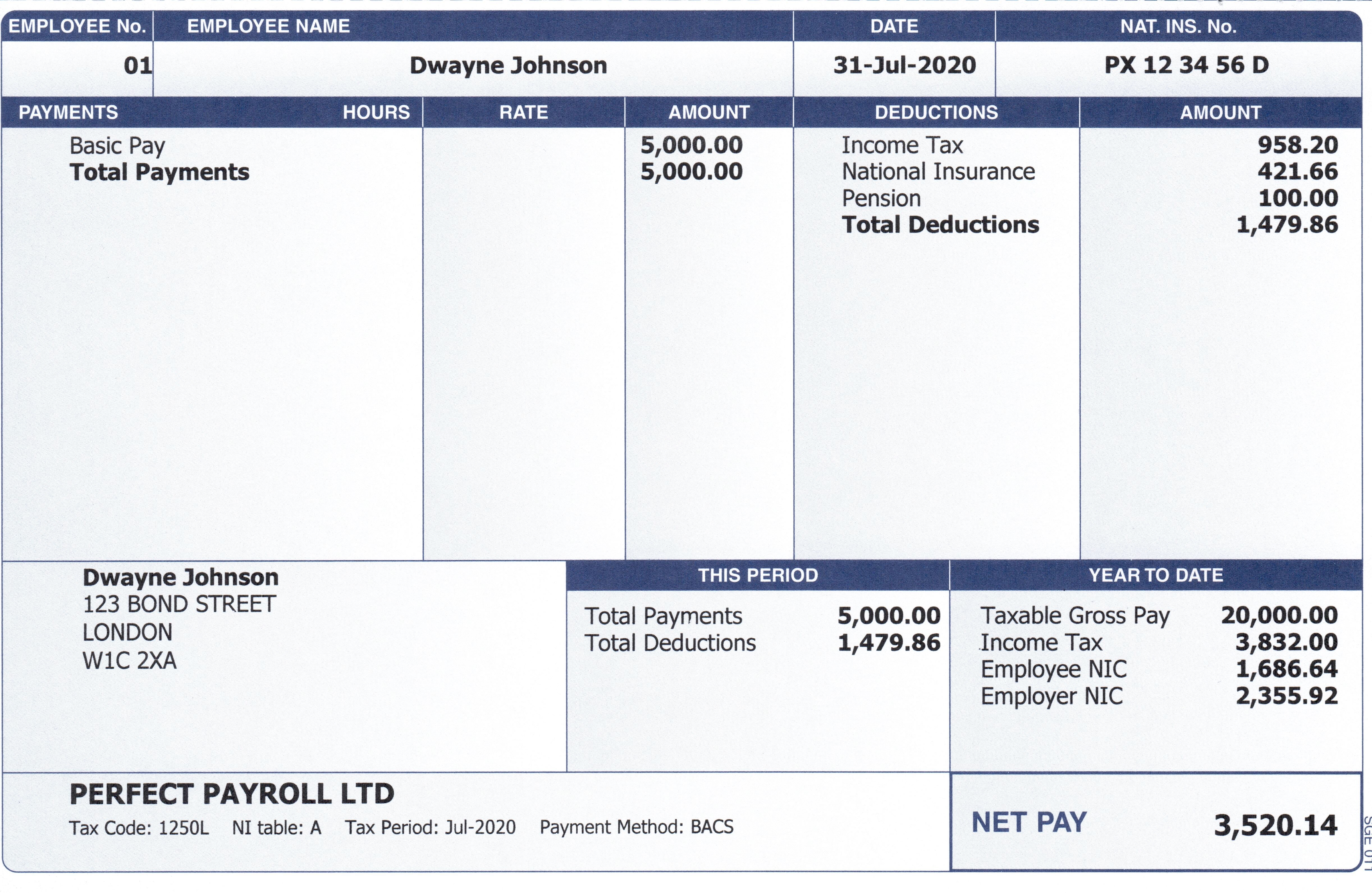

Payslip Template Uk

Understanding your employees’ net pay requires a clear grasp of payroll deductions and withholdings. Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your.

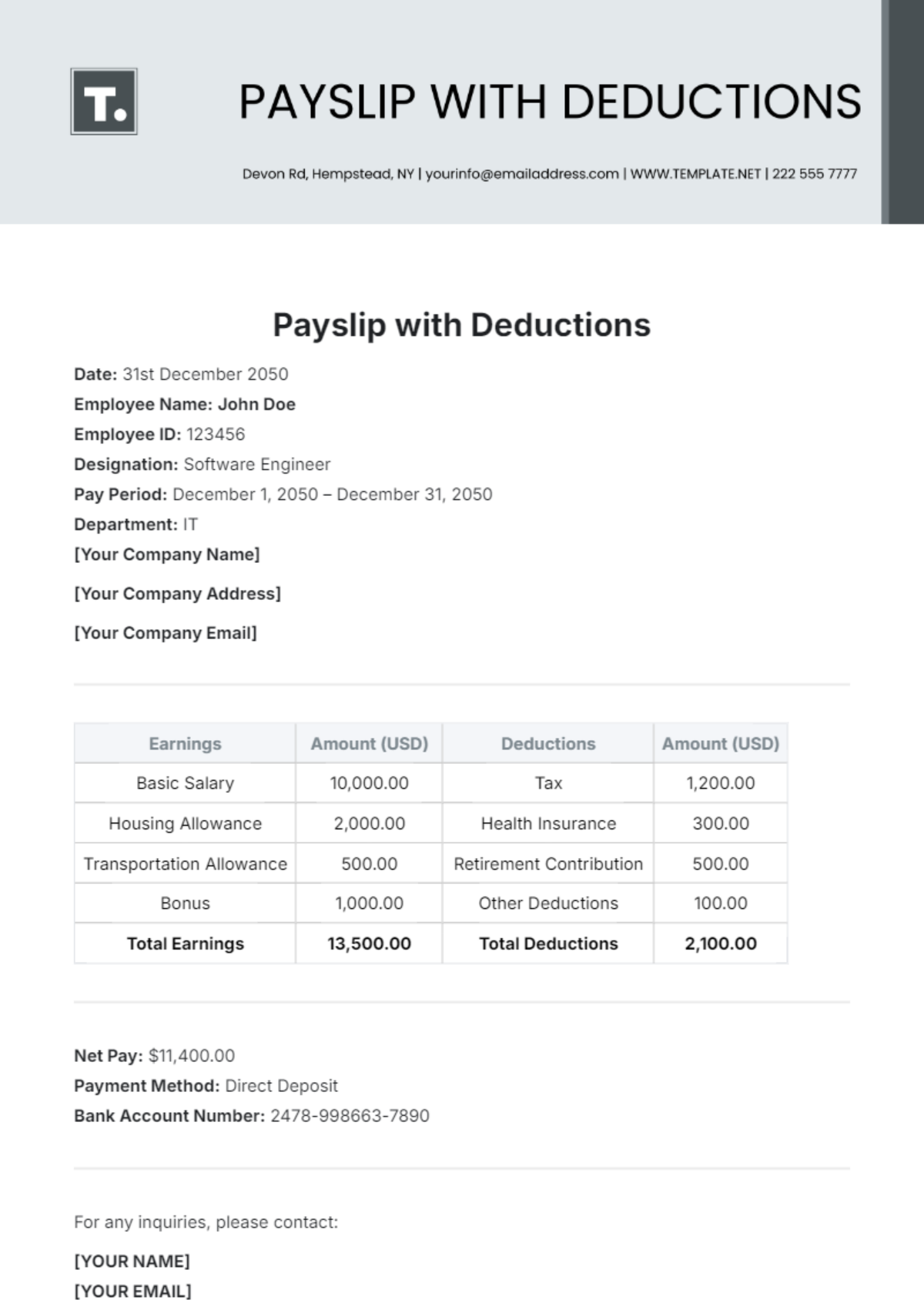

Free AI Payslip Generator, Free Payslip Maker Online

Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your. Understanding your employees’ net pay requires a clear grasp of payroll deductions and withholdings.

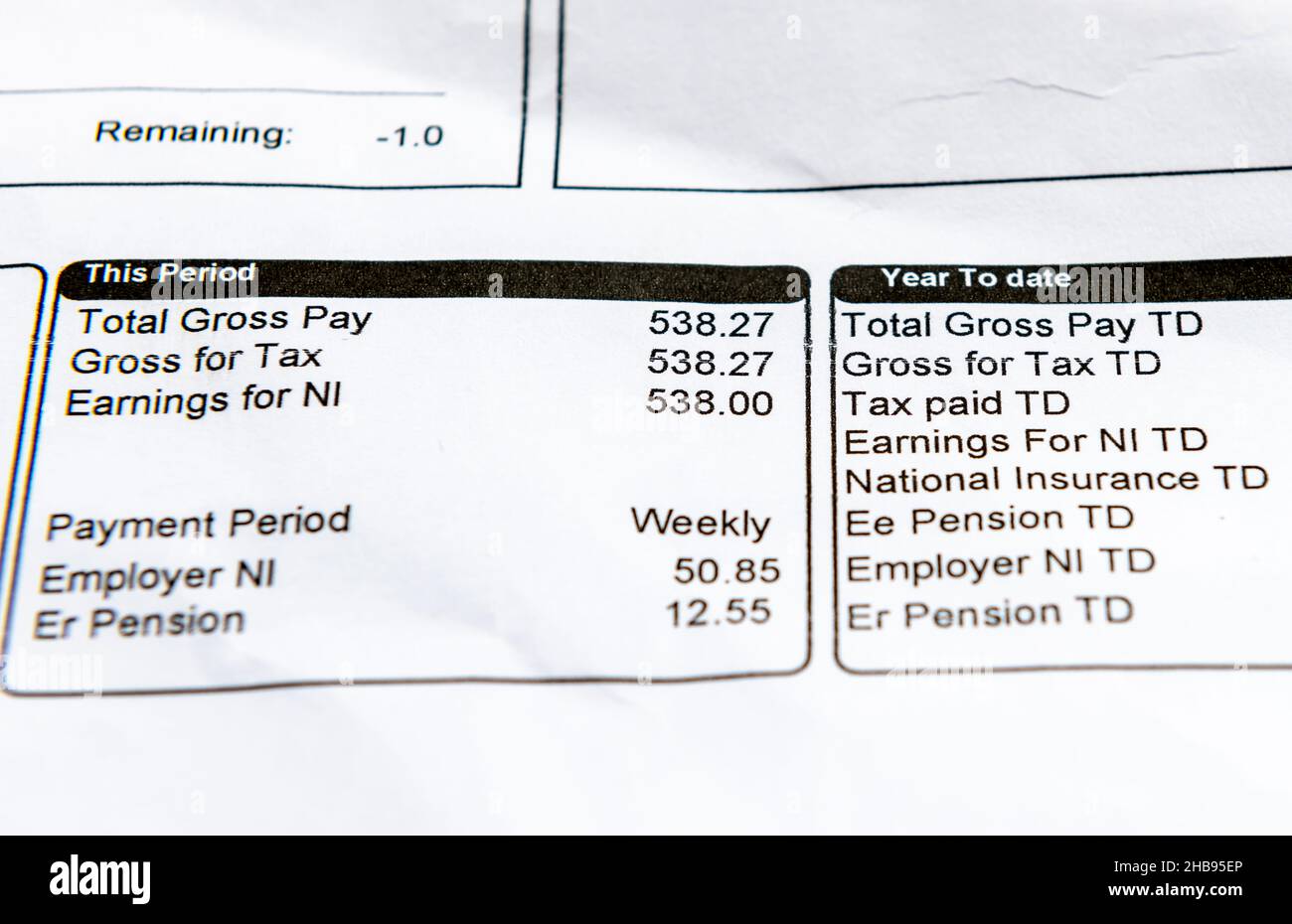

Payslip hires stock photography and images Alamy

Understanding your employees’ net pay requires a clear grasp of payroll deductions and withholdings. Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your.

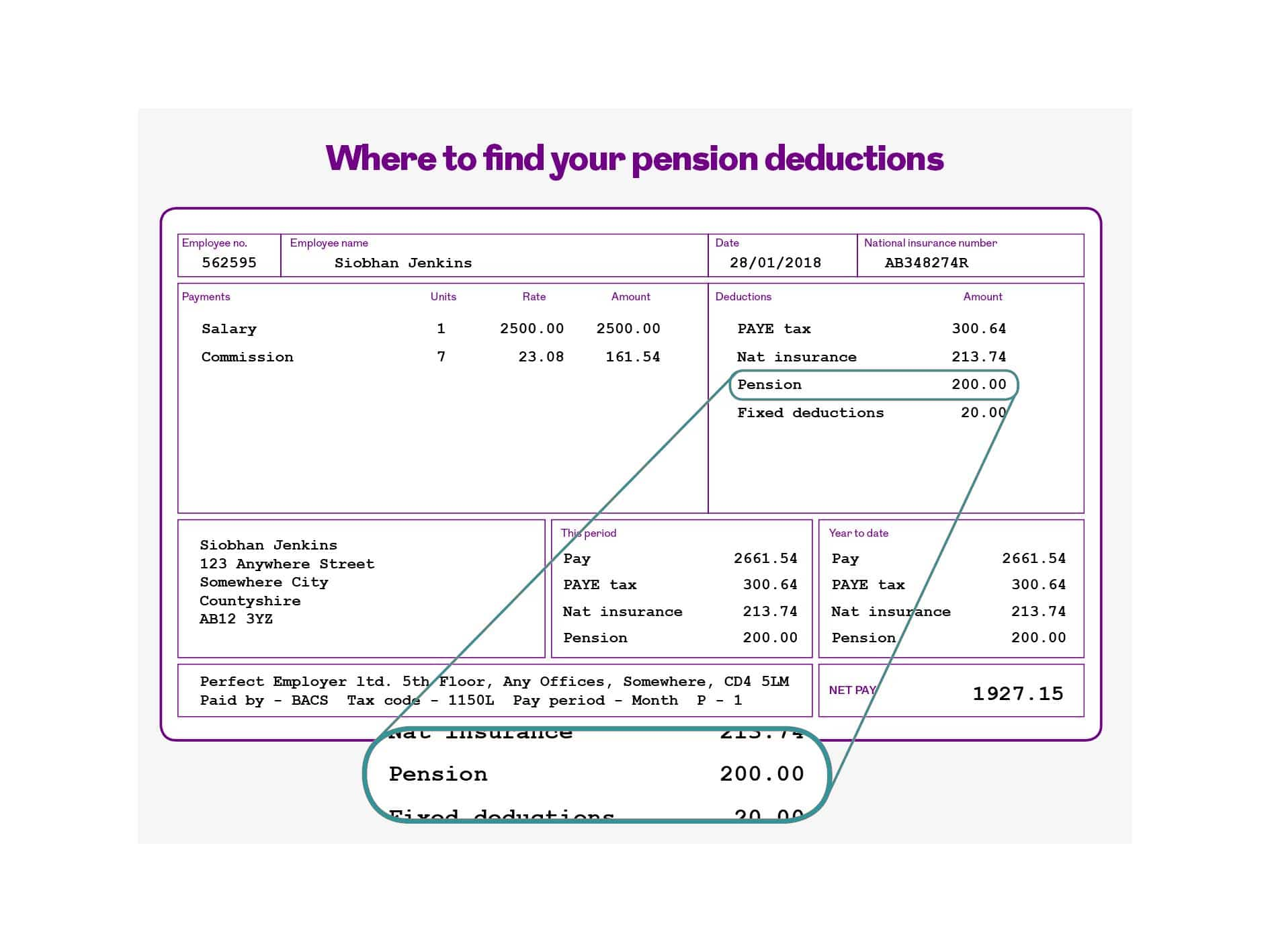

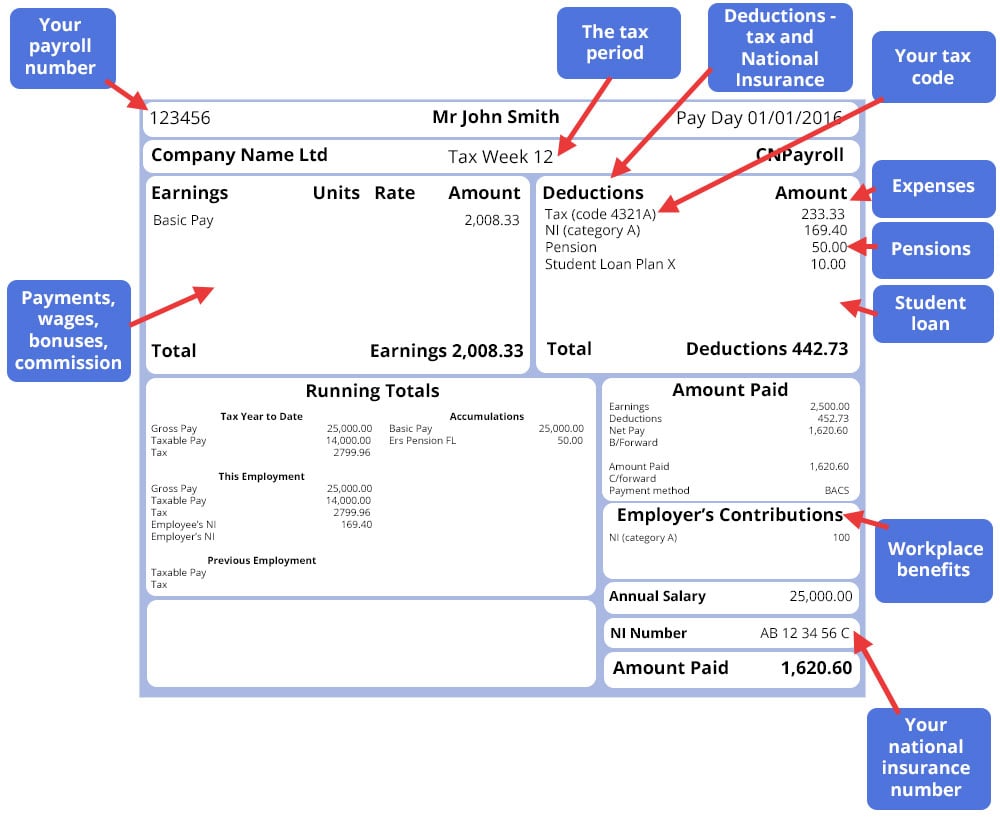

How to read your payslip pension deductions Royal London

Understanding your employees’ net pay requires a clear grasp of payroll deductions and withholdings. Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your.

Deductions on Payslip YouTube

Understanding your employees’ net pay requires a clear grasp of payroll deductions and withholdings. Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your.

Payslip Template Uk

Understanding your employees’ net pay requires a clear grasp of payroll deductions and withholdings. Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your.

Payslip Deductions Explained Payslipsplus

Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your. Understanding your employees’ net pay requires a clear grasp of payroll deductions and withholdings.

Payslip Sample Template Paysliper, 55 OFF

Understanding your employees’ net pay requires a clear grasp of payroll deductions and withholdings. Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your.

Payslip Explained Planday Images

Understanding your employees’ net pay requires a clear grasp of payroll deductions and withholdings. Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your.

Understanding Your Employees’ Net Pay Requires A Clear Grasp Of Payroll Deductions And Withholdings.

Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your.