Export Invoice In Inr - In order to promote growth of global trade with emphasis on exports from india and to support the increasing interest of global trading. 2 & 3 way po matching24/7 support Export invoices help the customs authority verify the shipments’ contents and calculate the applicable taxes on them. Deciding whether to invoice in inr or a foreign currency can significantly impact a business's financial management and. 2 & 3 way po matching24/7 support

In order to promote growth of global trade with emphasis on exports from india and to support the increasing interest of global trading. Deciding whether to invoice in inr or a foreign currency can significantly impact a business's financial management and. Export invoices help the customs authority verify the shipments’ contents and calculate the applicable taxes on them. 2 & 3 way po matching24/7 support 2 & 3 way po matching24/7 support

In order to promote growth of global trade with emphasis on exports from india and to support the increasing interest of global trading. Export invoices help the customs authority verify the shipments’ contents and calculate the applicable taxes on them. 2 & 3 way po matching24/7 support Deciding whether to invoice in inr or a foreign currency can significantly impact a business's financial management and. 2 & 3 way po matching24/7 support

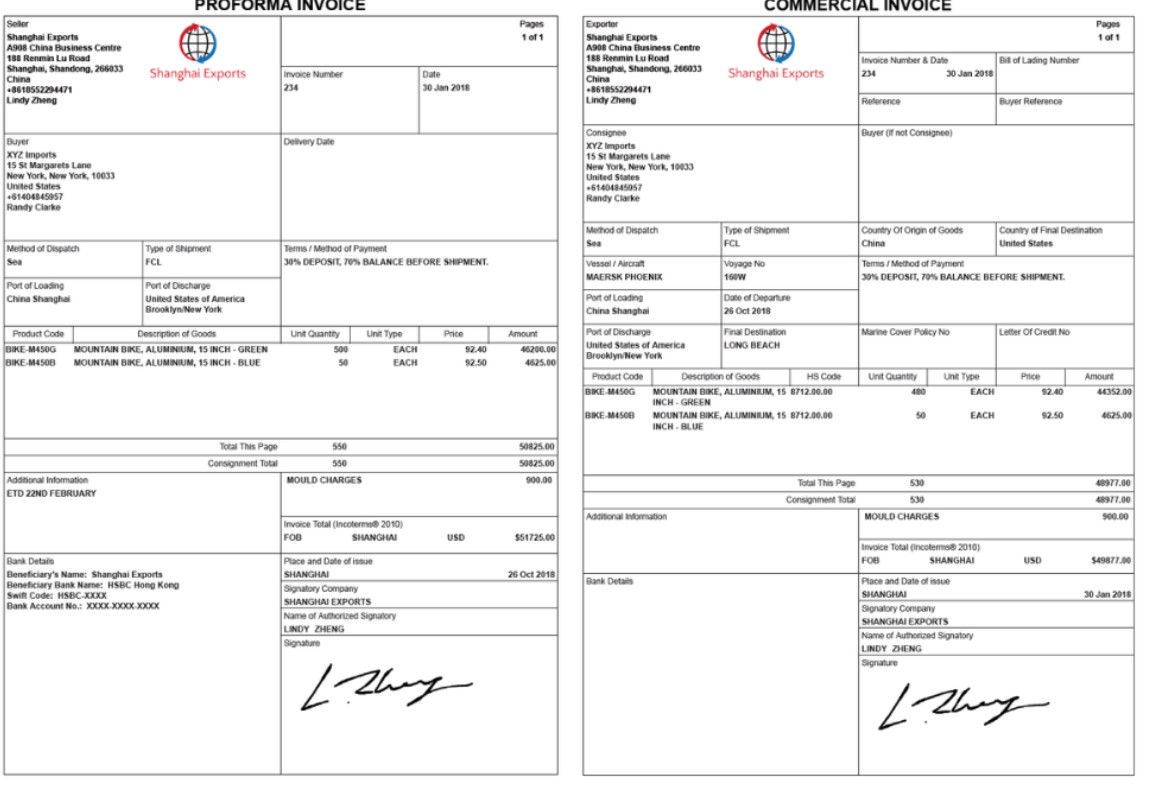

Export Invoice Meaning, Format, Uses, Timelimit to issue & Contents

2 & 3 way po matching24/7 support Deciding whether to invoice in inr or a foreign currency can significantly impact a business's financial management and. 2 & 3 way po matching24/7 support Export invoices help the customs authority verify the shipments’ contents and calculate the applicable taxes on them. In order to promote growth of global trade with emphasis on.

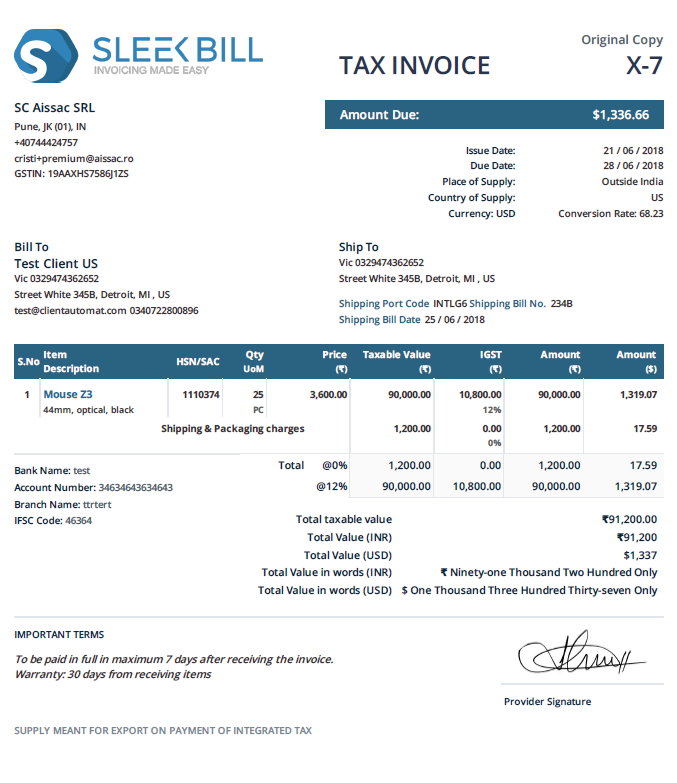

Can we make GST export invoices in Quick Books with both foreign

Export invoices help the customs authority verify the shipments’ contents and calculate the applicable taxes on them. In order to promote growth of global trade with emphasis on exports from india and to support the increasing interest of global trading. 2 & 3 way po matching24/7 support Deciding whether to invoice in inr or a foreign currency can significantly impact.

Gst Tax Invoice Format For Export New Invoice

2 & 3 way po matching24/7 support 2 & 3 way po matching24/7 support Export invoices help the customs authority verify the shipments’ contents and calculate the applicable taxes on them. In order to promote growth of global trade with emphasis on exports from india and to support the increasing interest of global trading. Deciding whether to invoice in inr.

Commercial invoice for export template bgress

Export invoices help the customs authority verify the shipments’ contents and calculate the applicable taxes on them. 2 & 3 way po matching24/7 support In order to promote growth of global trade with emphasis on exports from india and to support the increasing interest of global trading. Deciding whether to invoice in inr or a foreign currency can significantly impact.

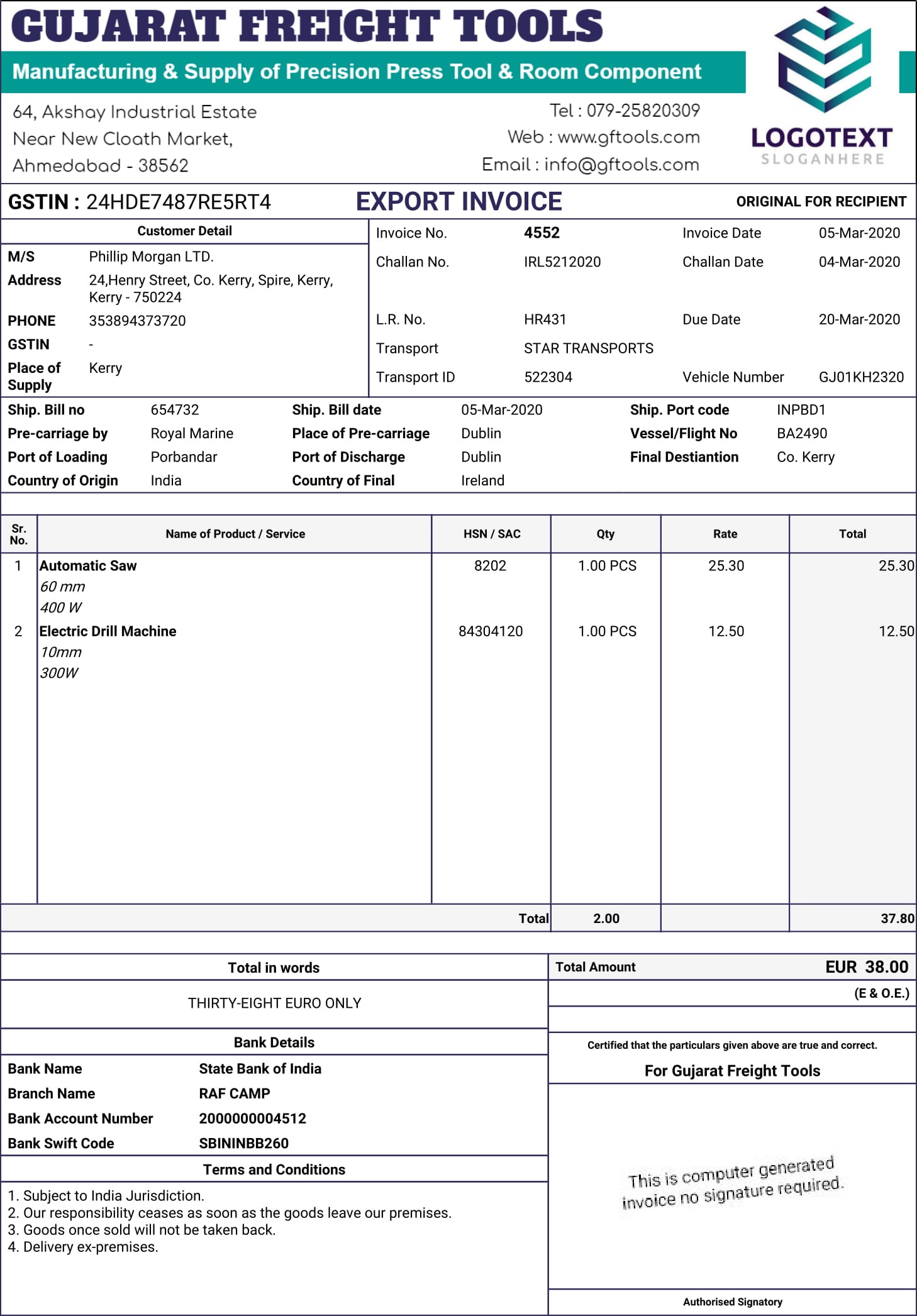

Types of Export Invoices A Comprehensive Guide for Seamless Global

2 & 3 way po matching24/7 support Export invoices help the customs authority verify the shipments’ contents and calculate the applicable taxes on them. 2 & 3 way po matching24/7 support Deciding whether to invoice in inr or a foreign currency can significantly impact a business's financial management and. In order to promote growth of global trade with emphasis on.

Export Invoices Should I Invoice in INR or Foreign Currency?

2 & 3 way po matching24/7 support In order to promote growth of global trade with emphasis on exports from india and to support the increasing interest of global trading. 2 & 3 way po matching24/7 support Deciding whether to invoice in inr or a foreign currency can significantly impact a business's financial management and. Export invoices help the customs.

22. INR InvoiceNo.5 (202425)for 90 ITC 5 lifts Download Free PDF

Deciding whether to invoice in inr or a foreign currency can significantly impact a business's financial management and. 2 & 3 way po matching24/7 support Export invoices help the customs authority verify the shipments’ contents and calculate the applicable taxes on them. 2 & 3 way po matching24/7 support In order to promote growth of global trade with emphasis on.

Multi Currency for Items Output Books Billing Software

In order to promote growth of global trade with emphasis on exports from india and to support the increasing interest of global trading. Deciding whether to invoice in inr or a foreign currency can significantly impact a business's financial management and. 2 & 3 way po matching24/7 support Export invoices help the customs authority verify the shipments’ contents and calculate.

Export Invoices Should I Invoice in INR or Foreign Currency?

2 & 3 way po matching24/7 support Deciding whether to invoice in inr or a foreign currency can significantly impact a business's financial management and. In order to promote growth of global trade with emphasis on exports from india and to support the increasing interest of global trading. Export invoices help the customs authority verify the shipments’ contents and calculate.

(Original For Recipient) INR One Thousand and Seventy Six and Twenty

In order to promote growth of global trade with emphasis on exports from india and to support the increasing interest of global trading. 2 & 3 way po matching24/7 support Deciding whether to invoice in inr or a foreign currency can significantly impact a business's financial management and. Export invoices help the customs authority verify the shipments’ contents and calculate.

2 & 3 Way Po Matching24/7 Support

In order to promote growth of global trade with emphasis on exports from india and to support the increasing interest of global trading. Deciding whether to invoice in inr or a foreign currency can significantly impact a business's financial management and. Export invoices help the customs authority verify the shipments’ contents and calculate the applicable taxes on them. 2 & 3 way po matching24/7 support