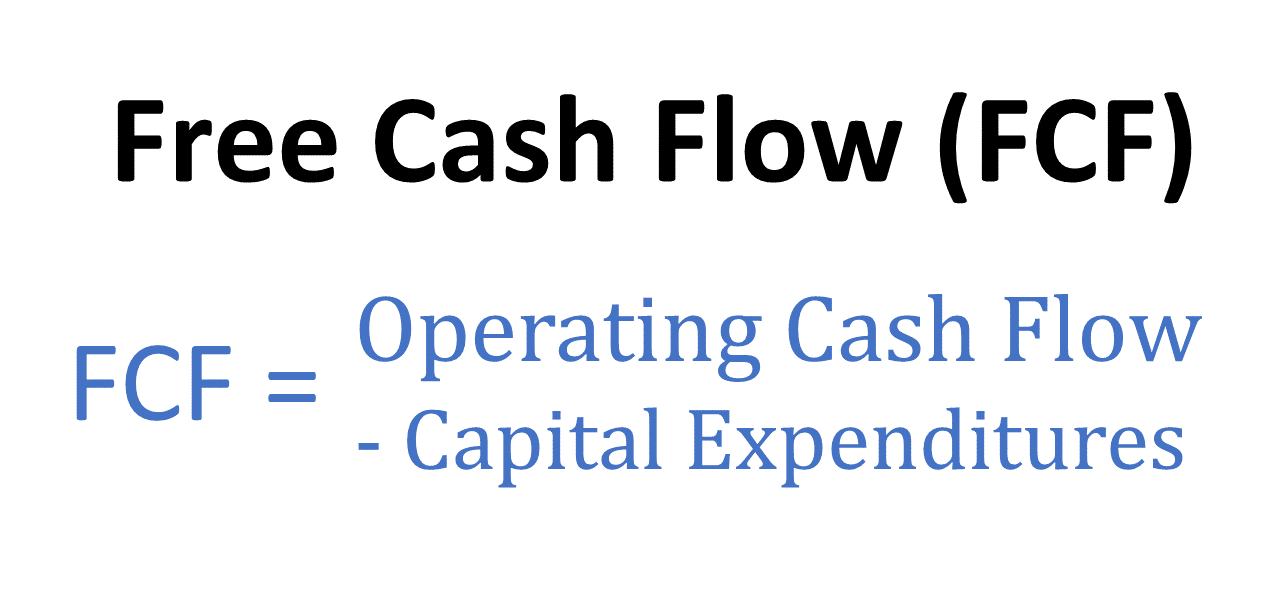

Free Cash Flows Formula - Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) using two formulas: Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures.

Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Learn how to calculate free cash flow (fcf) using two formulas: Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Fcf measures a company's ability to generate.

Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Learn how to calculate free cash flow (fcf) using two formulas: Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset.

How Can You Maximize Your Free Cash Flow? [Formula + Example]

Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Learn how to calculate free cash flow (fcf) using two formulas: Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures.

Free cash flow (FCF) Equation and meaning [2025]

Learn how to calculate free cash flow (fcf) using two formulas: Fcf measures a company's ability to generate. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures.

Awesome Equation For Free Cash Flow Preparing A Profit And Loss

Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Learn how to calculate free cash flow (fcf) using two formulas: Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Fcf measures a company's ability to generate.

(FCF) Free Cash Flow Formula and Calculation Financial

Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) using two formulas: Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset.

Free cash flow (FCF) Equation and meaning [2025]

Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) using two formulas: Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset.

Free Cash Flow Plan Projections

Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Learn how to calculate free cash flow (fcf) using two formulas: Fcf measures a company's ability to generate.

Free Cash Flow (FCF) Formula

Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Learn how to calculate free cash flow (fcf) using two formulas:

Free Cash Flow (FCF) Definition, Formula and How to Calculate Stock

Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Learn how to calculate free cash flow (fcf) using two formulas:

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) using two formulas: Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Learn how to calculate free cash flow (fcf) using two formulas:

Fcf Measures A Company's Ability To Generate.

Learn how to calculate free cash flow (fcf) using two formulas: Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset.

![How Can You Maximize Your Free Cash Flow? [Formula + Example]](https://cfoperspective.com/wp-content/uploads/2023/02/Free-Cash-Flow-Example-1024x576.png)

![Free cash flow (FCF) Equation and meaning [2025]](https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/quickbooks_paymentseditorial9_graphic1b.jpg)

![Free cash flow (FCF) Equation and meaning [2025]](https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/quickbooks_paymentseditorial9_graphic4.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)