How To Know My Tax Deduction - Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. See how your withholding affects your refund, paycheck. Learn how it affects your taxable income.

Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Learn how it affects your taxable income. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. See how your withholding affects your refund, paycheck. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into.

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. See how your withholding affects your refund, paycheck. Learn how it affects your taxable income.

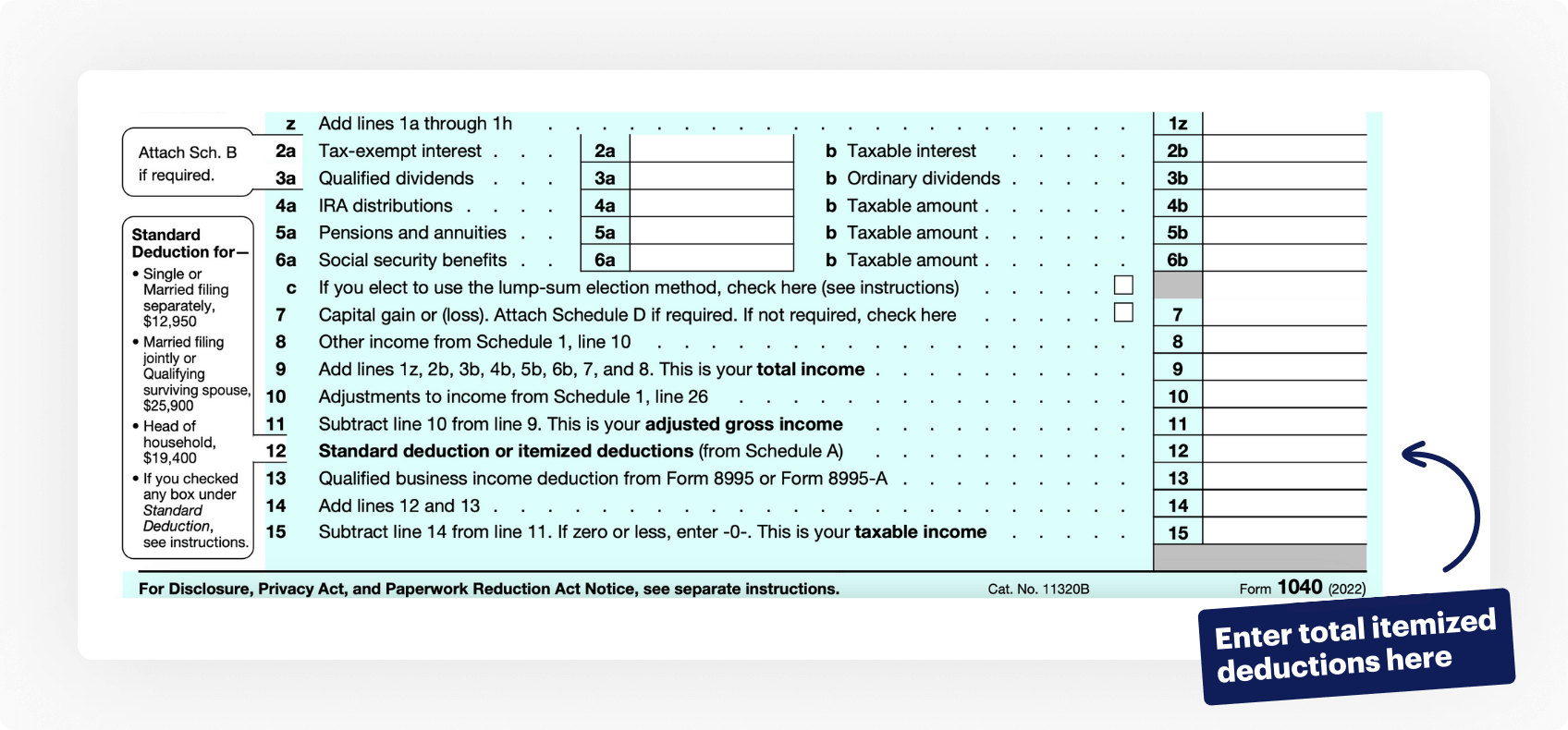

Understanding Tax Deductions Itemized vs. Standard Deduction

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. See how your withholding affects your refund, paycheck. Learn how it affects your taxable income. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year..

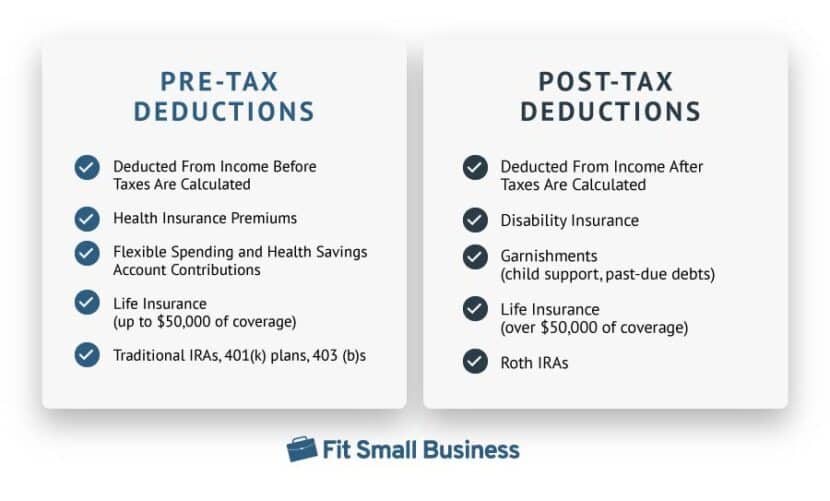

Pretax Deductions & Posttax Deductions An Ultimate Guide

Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Learn how it affects your taxable income. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. See how your withholding affects your refund, paycheck. One way to be sure whether you took the.

Business Tax Deductions Cheat Sheet Excel in PINK Tax Etsy Australia

Your standard deduction depends on your filing status, age and whether a taxpayer is blind. See how your withholding affects your refund, paycheck. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. One way to be sure whether you took the standard or itemized deduction is to look.

Tax basics Understanding the difference between standard and itemized

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. See how your withholding affects your refund, paycheck. Learn how it affects your taxable income. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. One way to be sure whether you took the.

Tax Act Where Can You Claim Tax Deductions?

See how your withholding affects your refund, paycheck. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. Learn how it affects your taxable income. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year..

The master list of all types of tax deductions infographic Artofit

Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. Learn how it affects your taxable income. One way to be sure whether you took the standard or itemized deduction is to look at.

Itemized Deduction Definition TaxEDU Glossary

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year..

Schedule A (Form 1040) Itemized Deductions For 2025 Lilly S Solorio

Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Learn how it affects your taxable income. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. One way to be sure whether you took the standard or itemized deduction is to look at.

What are the 5 different tax deductions? Leia aqui What are 5 types of

Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Learn how it affects your taxable income. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. See how your withholding affects your refund, paycheck. Use smartasset's paycheck calculator to calculate.

Credit Cards and Itemized Deductions What to Know Before Filing Your

See how your withholding affects your refund, paycheck. One way to be sure whether you took the standard or itemized deduction is to look at your turbo tax forms from last year. Your standard deduction depends on your filing status, age and whether a taxpayer is blind. Learn how it affects your taxable income. Use smartasset's paycheck calculator to calculate.

One Way To Be Sure Whether You Took The Standard Or Itemized Deduction Is To Look At Your Turbo Tax Forms From Last Year.

See how your withholding affects your refund, paycheck. Learn how it affects your taxable income. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. Your standard deduction depends on your filing status, age and whether a taxpayer is blind.

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)