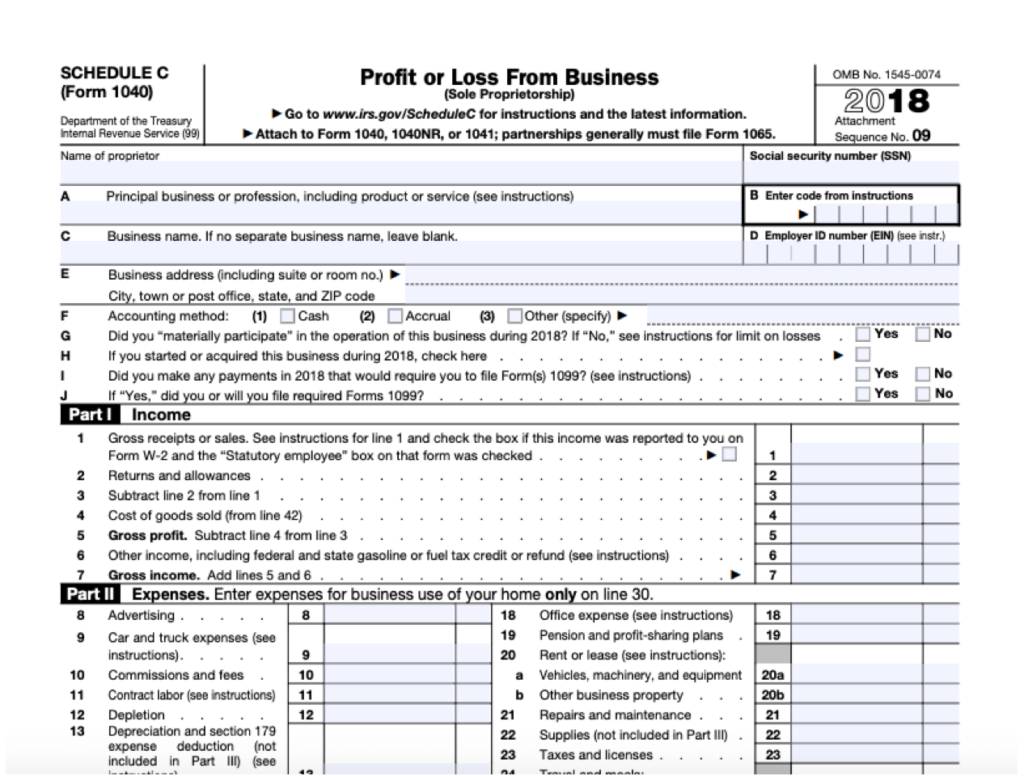

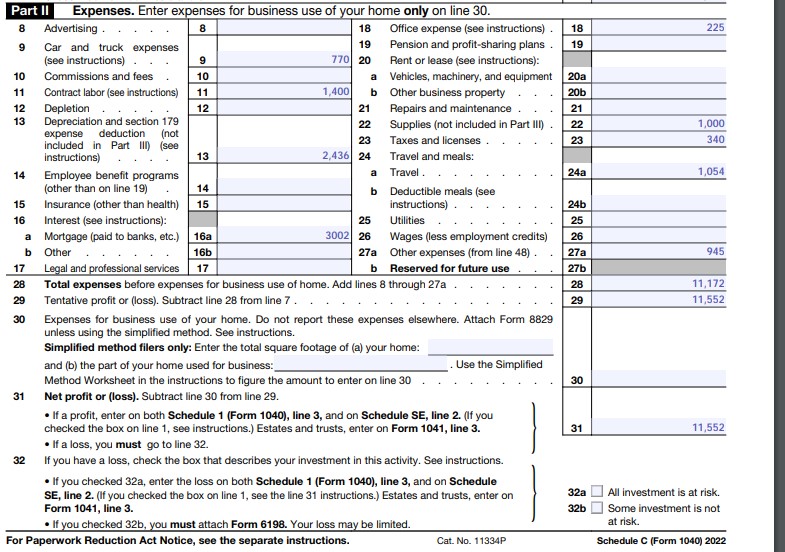

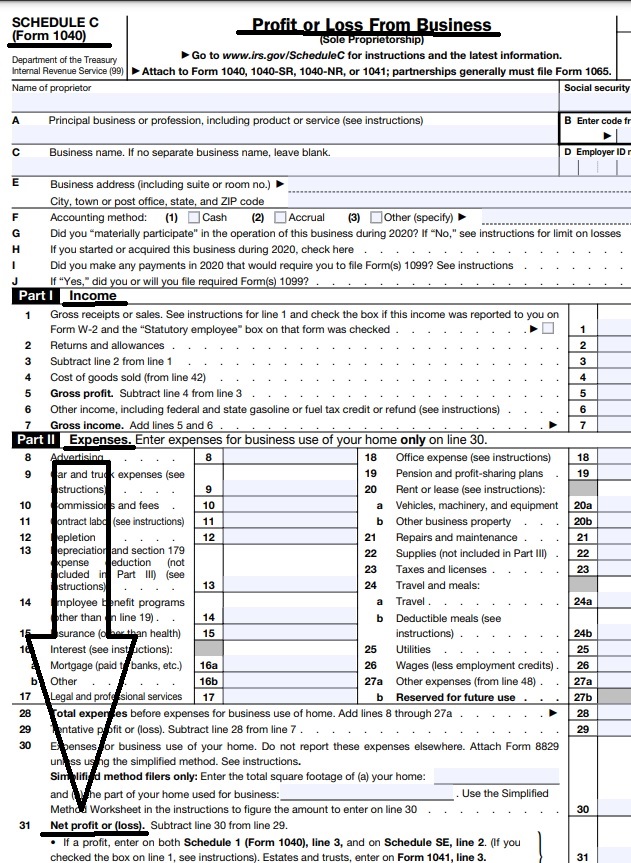

Instructions For 2024 Schedule C - Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. What is irs schedule c (form 1040)? • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on.

What is irs schedule c (form 1040)? Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. (if you checked the box on.

What is irs schedule c (form 1040)? Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. (if you checked the box on. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to.

2024 Instructions For Forms 2024C And 2024C C Corp Cathie Doralyn

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. (if you checked the box on. In this article, we’ll walk you through.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

(if you checked the box on. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. What is irs schedule c (form 1040)? Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a.

2024 Schedule C Alia Louise

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. What is irs schedule c (form 1040)? In this article, we’ll walk you through.

Schedule C Instructions 2024 Pdf Download Roxy Catarina

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. What is irs schedule c (form 1040)? Use schedule c (form 1040) to report income.

Schedule C Instructions 2024 Instructions Ivett Letisha

What is irs schedule c (form 1040)? • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. (if you checked the box on..

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business,.

Instructions For Schedule C 2024 Retha Hyacinthia

(if you checked the box on. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. • if you checked 32a,.

2024 Instructions Schedule C domino's pizza carte

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. In this article, we’ll walk you through everything you need to know about.

2024 Form 1040 Schedule C Instructions Meaning Lydia Rochell

What is irs schedule c (form 1040)? Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. (if you checked the.

2024 Instructions For Forms 2024C And 2024C Csc Kitti Lindsay

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. Use schedule c (form 1040) to report.

• If You Checked 32A, Enter The Loss On Both Schedule 1 (Form 1040), Line 3, And On Schedule Se, Line 2.

In this article, we’ll walk you through everything you need to know about the schedule c tax form, from what it is to how to. What is irs schedule c (form 1040)? (if you checked the box on. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)