King County Property Tax Appeal Form - Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. There are several types of property tax appeals handled at the washington state board of tax appeal (wsbta). Find, download, and fill out forms for your petition on our appeals forms page. Most matters filed with the. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. For real property appeals, use the real property petition form and. The king county tax advisor’s. To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. Comparable property sales analysis **comparable sales to complete this form may be obtained from:

Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. Find, download, and fill out forms for your petition on our appeals forms page. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. There are several types of property tax appeals handled at the washington state board of tax appeal (wsbta). Comparable property sales analysis **comparable sales to complete this form may be obtained from: The king county tax advisor’s. For real property appeals, use the real property petition form and. Most matters filed with the. The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate.

The king county tax advisor’s. To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. There are several types of property tax appeals handled at the washington state board of tax appeal (wsbta). Find, download, and fill out forms for your petition on our appeals forms page. For real property appeals, use the real property petition form and. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. Most matters filed with the. Comparable property sales analysis **comparable sales to complete this form may be obtained from: Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or.

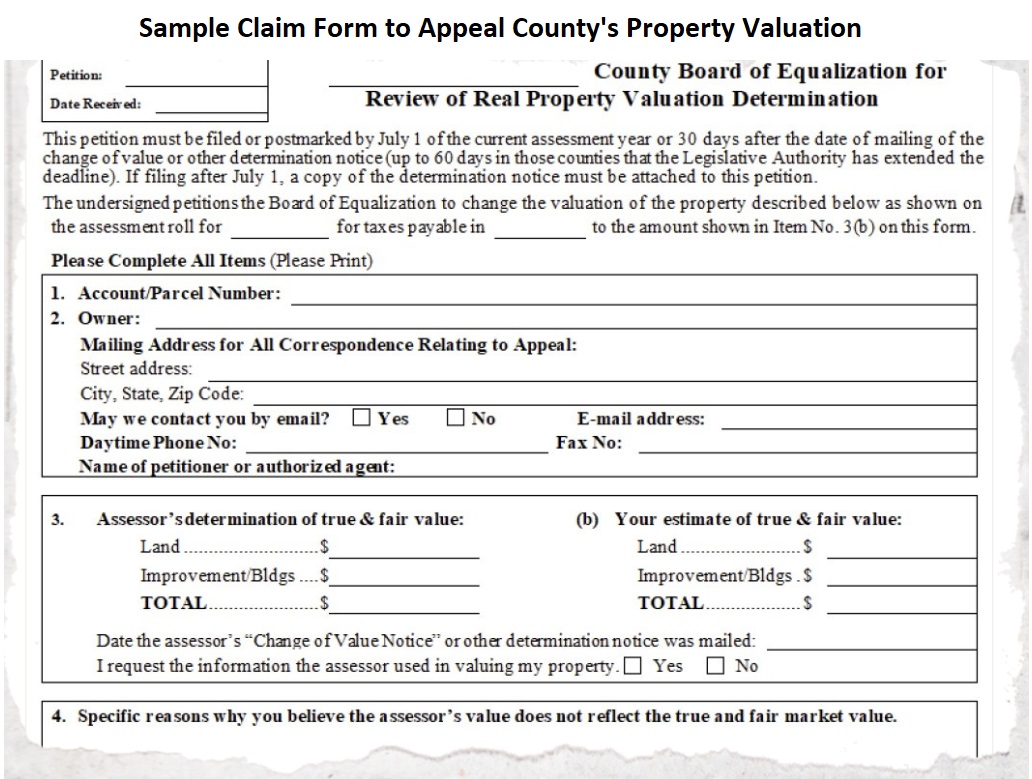

Onslow County Property Tax Appeals Form

Comparable property sales analysis **comparable sales to complete this form may be obtained from: Most matters filed with the. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. Use this form for appealing denial of an application from the assessor, removal from the current use or forest.

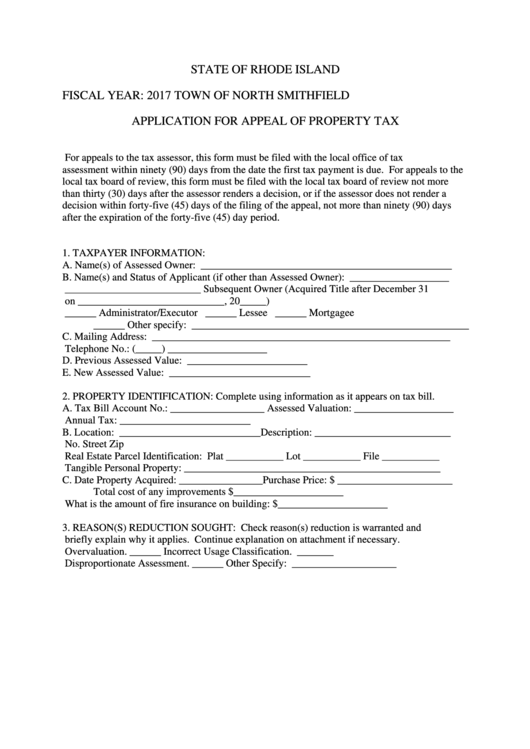

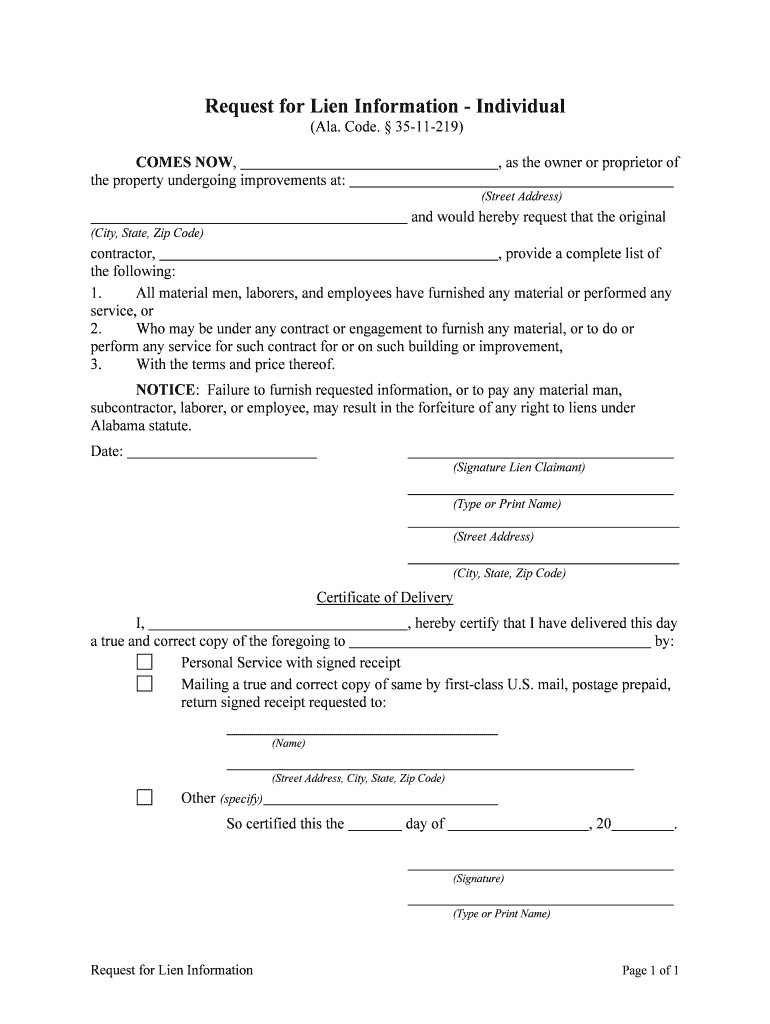

Application Form For Appeal Of Property Tax Printable Pdf Download

The king county tax advisor’s. Most matters filed with the. There are several types of property tax appeals handled at the washington state board of tax appeal (wsbta). The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. Use this form for appealing denial of an application from the.

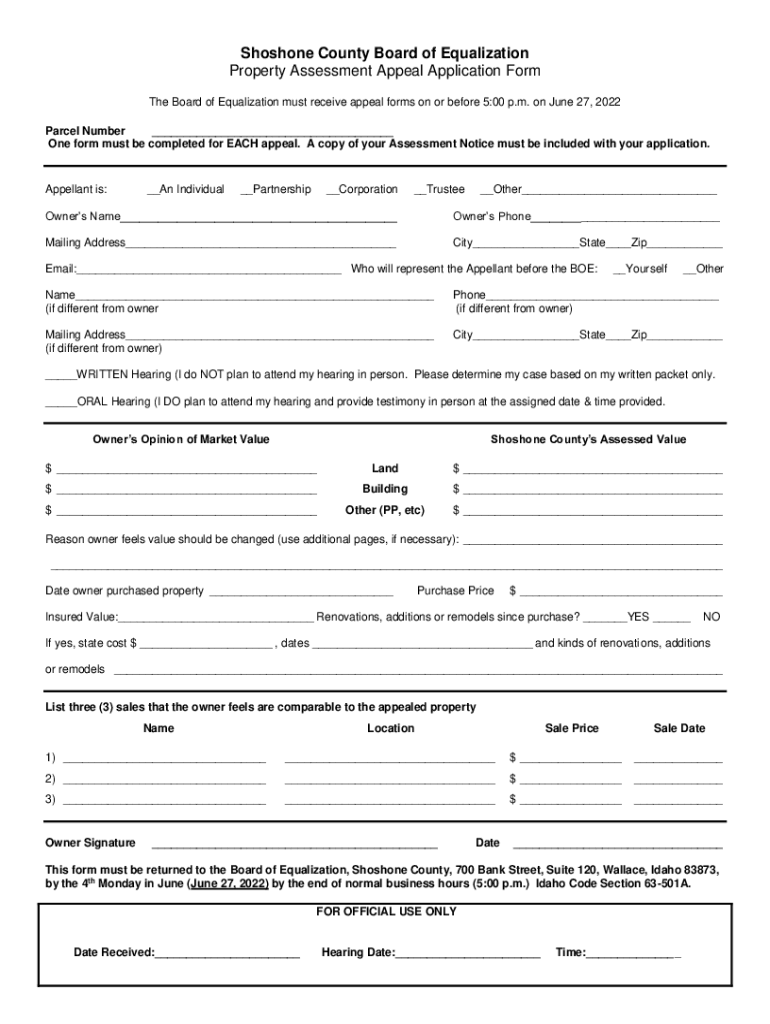

Fillable Online Property Assessment Appeal Application Form Fax Email

Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. For real property appeals, use the real property petition form and. To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. Use this form for appealing denial of.

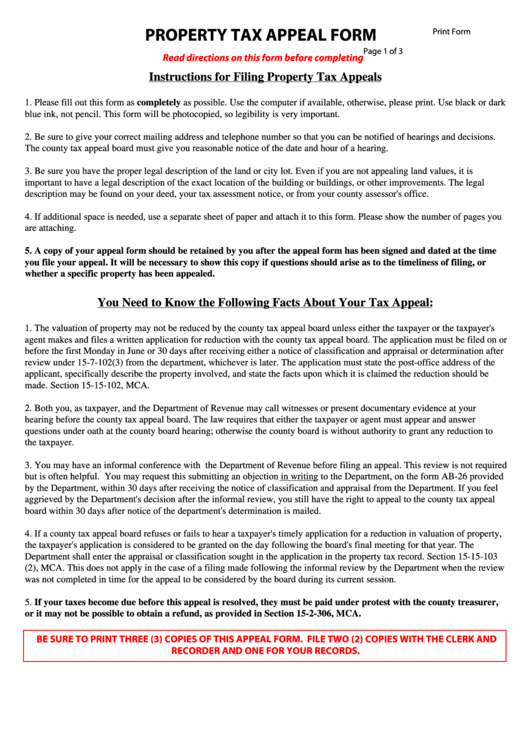

Fillable Property Tax Appeal Form Montana Department Of Revenue

For real property appeals, use the real property petition form and. The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. Most matters filed with the. Find,.

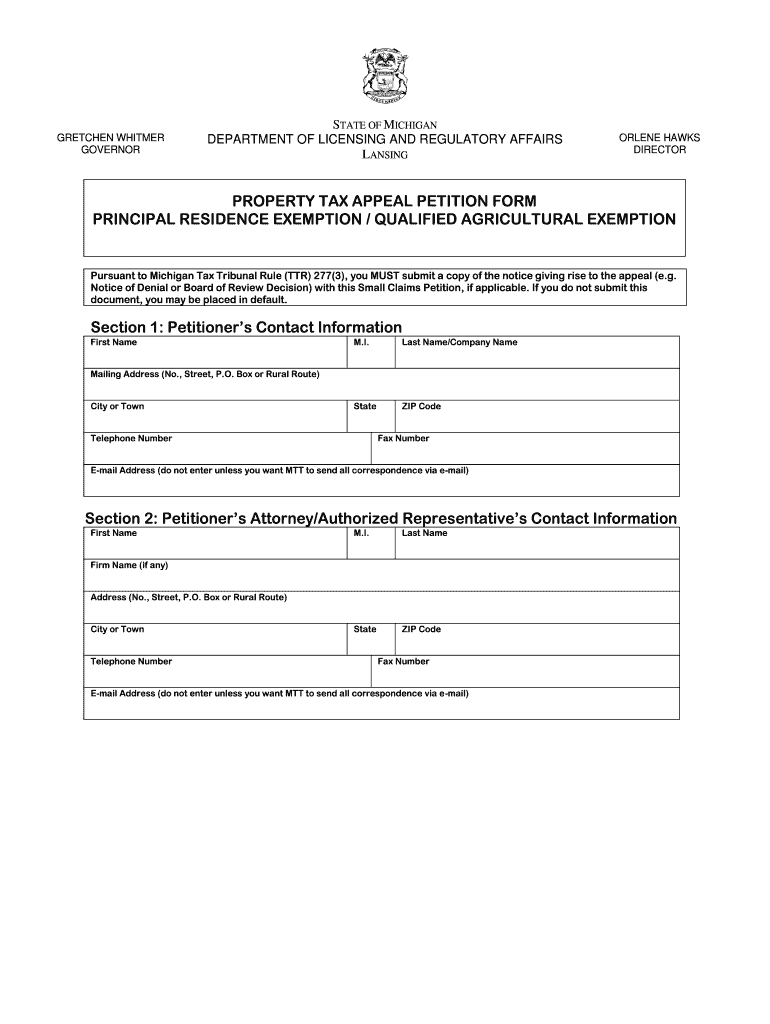

Michigan Property Tax Appeal Complete with ease airSlate SignNow

Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. For real property appeals, use the real property petition form and. Most matters filed with the. To.

Writing a Property Tax Appeal Letter with Sample Form Fill Out and

Most matters filed with the. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. The king county tax advisor’s. There are several types of property tax appeals handled at the washington state board of tax appeal (wsbta). The tax appeal process in king county is your legal.

Will County Property Tax Appeal Deadline 2024 Noemi Angeline

For real property appeals, use the real property petition form and. The king county tax advisor’s. To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. Comparable property sales analysis **comparable sales to complete this form may be obtained from: Find, download, and fill out forms for your petition on.

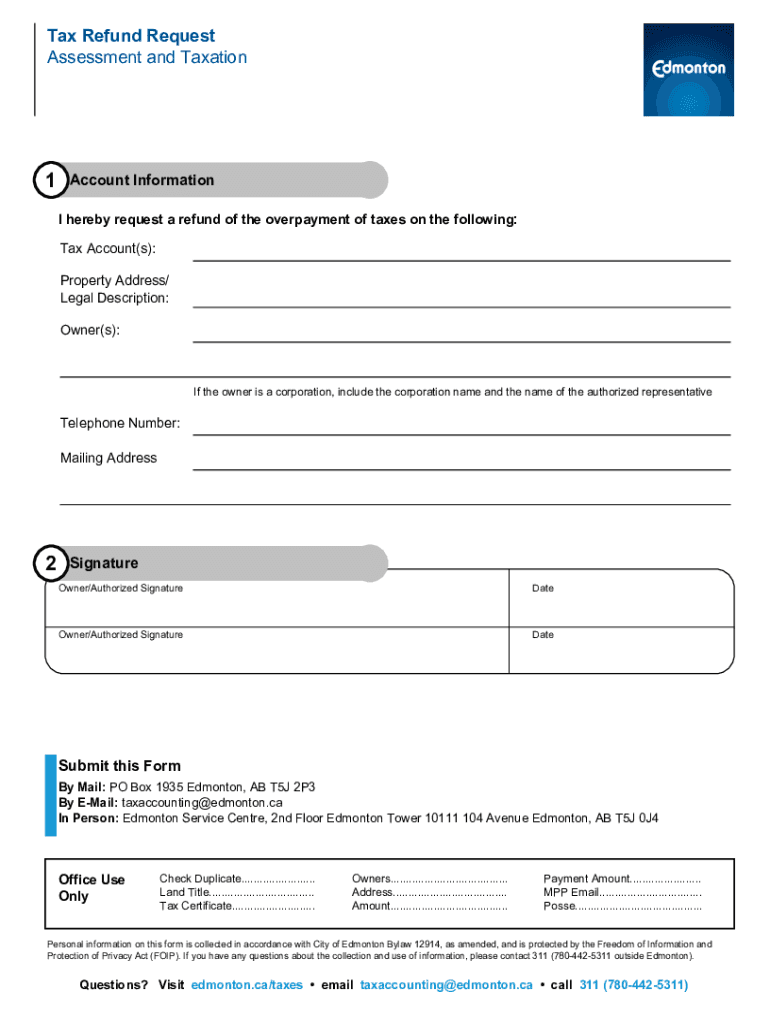

Fillable Online Property Tax Refund Request Form. Property Tax Refund

Most matters filed with the. Find, download, and fill out forms for your petition on our appeals forms page. For real property appeals, use the real property petition form and. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. The king county tax advisor’s.

How to Appeal Your Property Taxes in King County Will Springer

To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. Most matters filed with the. Find, download, and fill out forms for your petition on our appeals forms page..

Fillable Online Property Tax Appeal form Fax Email Print pdfFiller

There are several types of property tax appeals handled at the washington state board of tax appeal (wsbta). Comparable property sales analysis **comparable sales to complete this form may be obtained from: The king county tax advisor’s. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. Find,.

The King County Tax Advisor’s.

Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. For real property appeals, use the real property petition form and. Most matters filed with the. There are several types of property tax appeals handled at the washington state board of tax appeal (wsbta).

Comparable Property Sales Analysis **Comparable Sales To Complete This Form May Be Obtained From:

Find, download, and fill out forms for your petition on our appeals forms page. To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or.