Operating Cash Flow Ratio Formula - The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

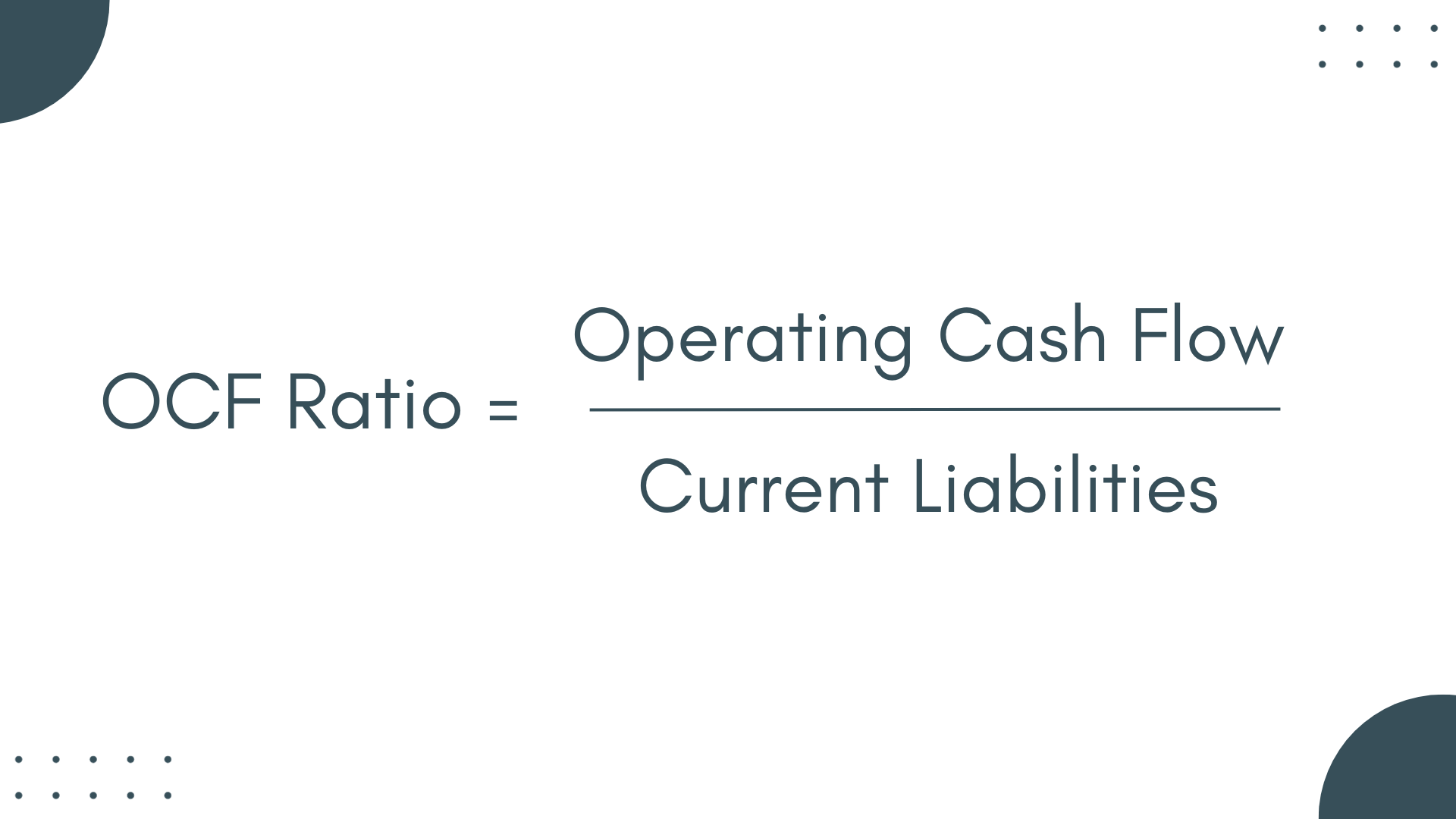

Operating Cash Flow Ratio Understanding and Calculating

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

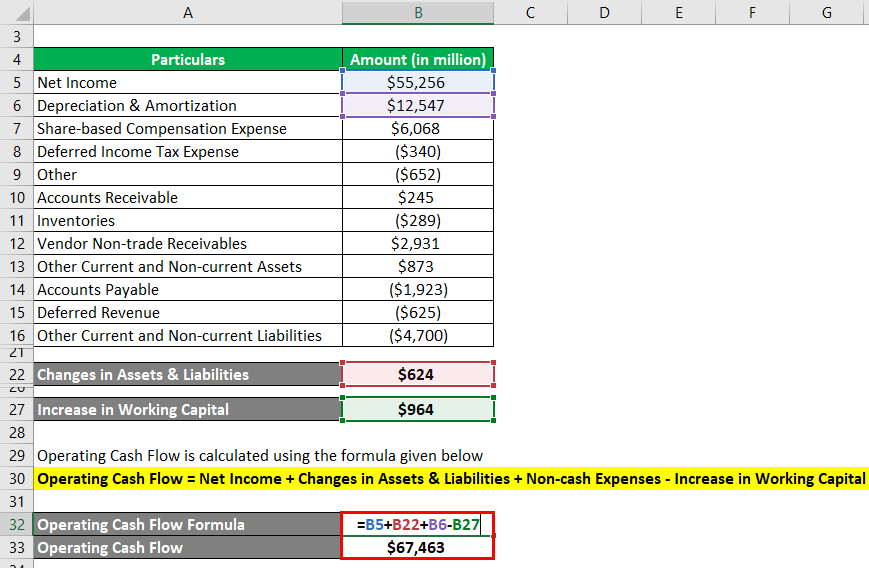

Operating Cash Flow Formula Examples with excel template & calculator

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

Operating Cash Flow Ratio Definition and Formula

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

Liquidity Ratio All You Need to Know About Liquidity Ratios

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

cash flow calculator DrBeckmann

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

Operating Cash Flow Overview, Example, Formula

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

Operating free cashflow pastortune

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

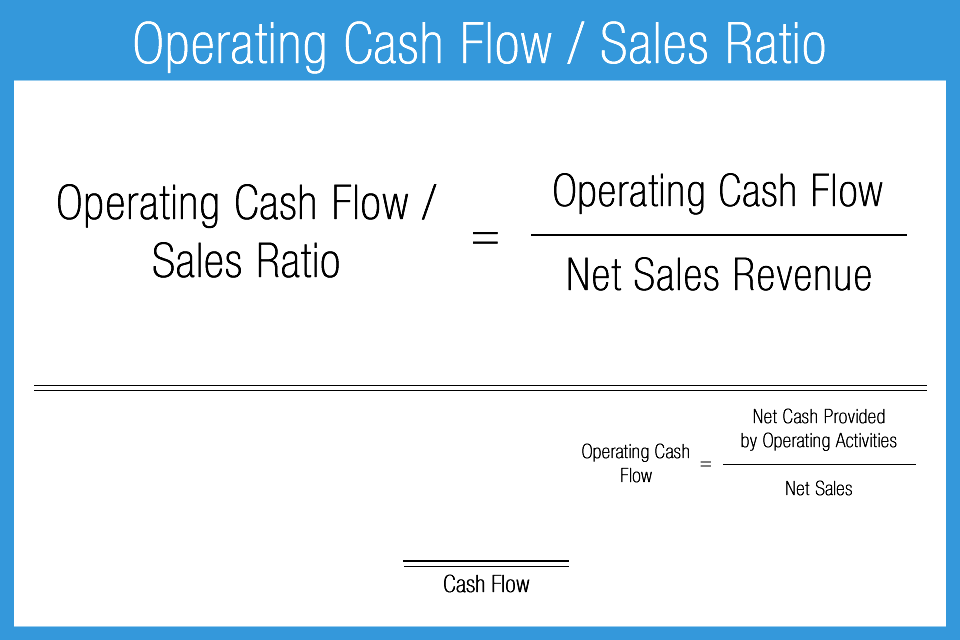

How Do You Calculate Operating Cash Flow To Sales Ratio

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

operating cash flow ratio industry average Odilia Card

Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store. The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.

Operating Cash Flow Formula Examples with excel template & calculator

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current. Learn how to calculate operating cash flow (ocf) using the direct and indirect methods, and see an example for a music retail store.

Learn How To Calculate Operating Cash Flow (Ocf) Using The Direct And Indirect Methods, And See An Example For A Music Retail Store.

The operating cash flow (ocf) ratio is a financial metric used to determine how effectively a company can cover its current.