Schedule A Worksheet 2024 - Go to www.irs.gov/schedulea for instructions and the latest information. This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. Enter your expenses for medical, charity,. Download and complete this worksheet to calculate your itemized deductions for tax year 2024. 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. State and local sales tax deduction worksheet note:

Go to www.irs.gov/schedulea for instructions and the latest information. State and local sales tax deduction worksheet note: 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. Download and complete this worksheet to calculate your itemized deductions for tax year 2024. Enter your expenses for medical, charity,. Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service.

Download and complete this worksheet to calculate your itemized deductions for tax year 2024. Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. Enter your expenses for medical, charity,. 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) Go to www.irs.gov/schedulea for instructions and the latest information. State and local sales tax deduction worksheet note:

Schedule E Worksheet 2024 Turbotax 2024 Schedule A

See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. State and local sales tax deduction worksheet note: Enter your expenses for medical, charity,. Go to www.irs.gov/schedulea for instructions and the latest information. 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200)

craftcation 2024 schedule planning worksheets Dear Handmade Life

2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) Enter your expenses for medical, charity,. Go to www.irs.gov/schedulea for instructions and the latest information. This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. See the schedule a instructions if taxpayer lived in more.

Irs Schedule E 2024 Printable Karry Marylee

Enter your expenses for medical, charity,. Download and complete this worksheet to calculate your itemized deductions for tax year 2024. 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. See the schedule a instructions.

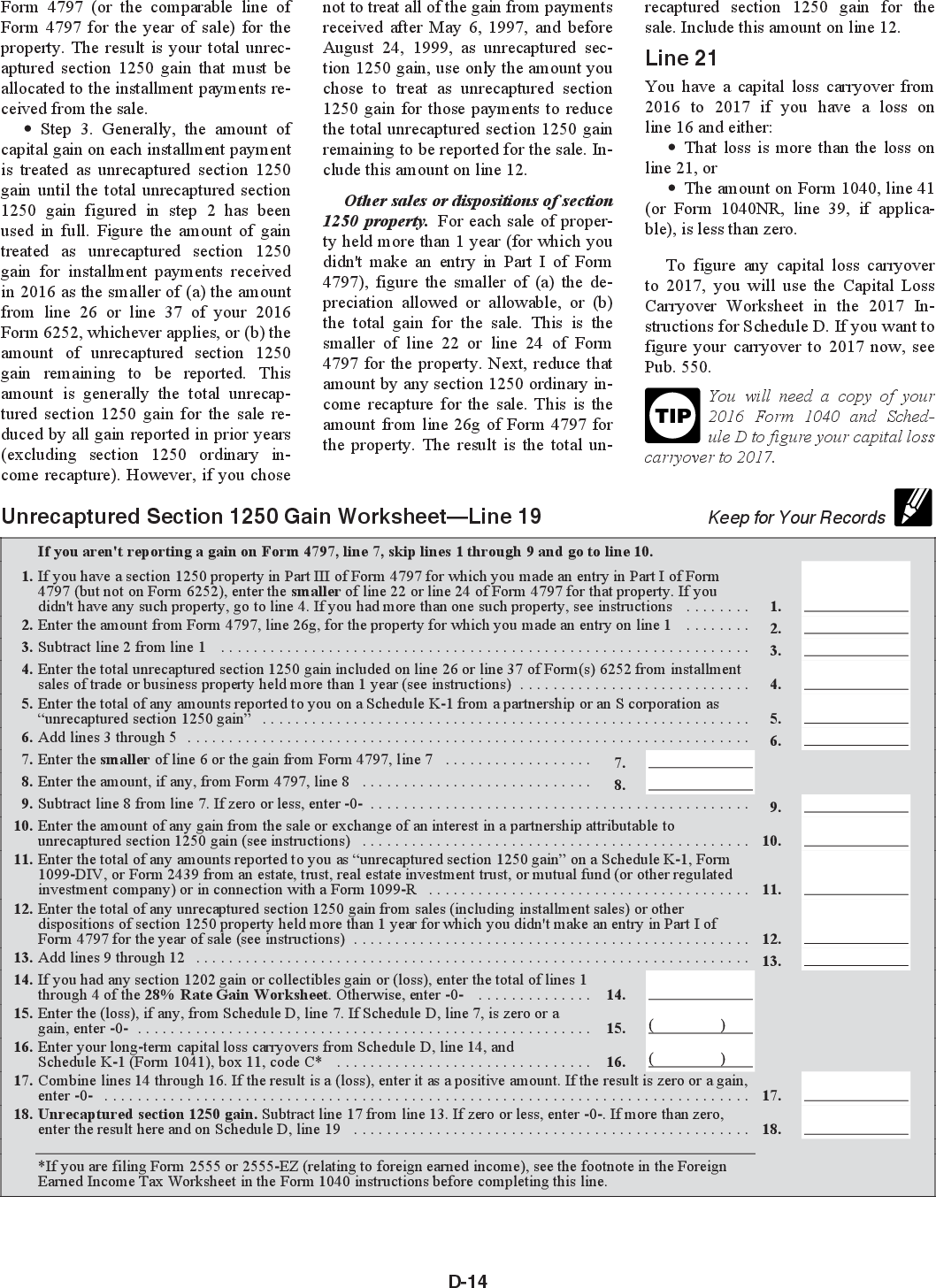

Schedule D Tax Worksheet 2020

See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. State and local sales tax deduction worksheet note: This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. Enter your expenses for medical, charity,. Download or print the 2024 federal (itemized deductions).

Schedule D (Form 1040) Report Capital Gains & Losses [2024

State and local sales tax deduction worksheet note: See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. Enter your expenses for medical, charity,. Download and complete this worksheet to calculate your.

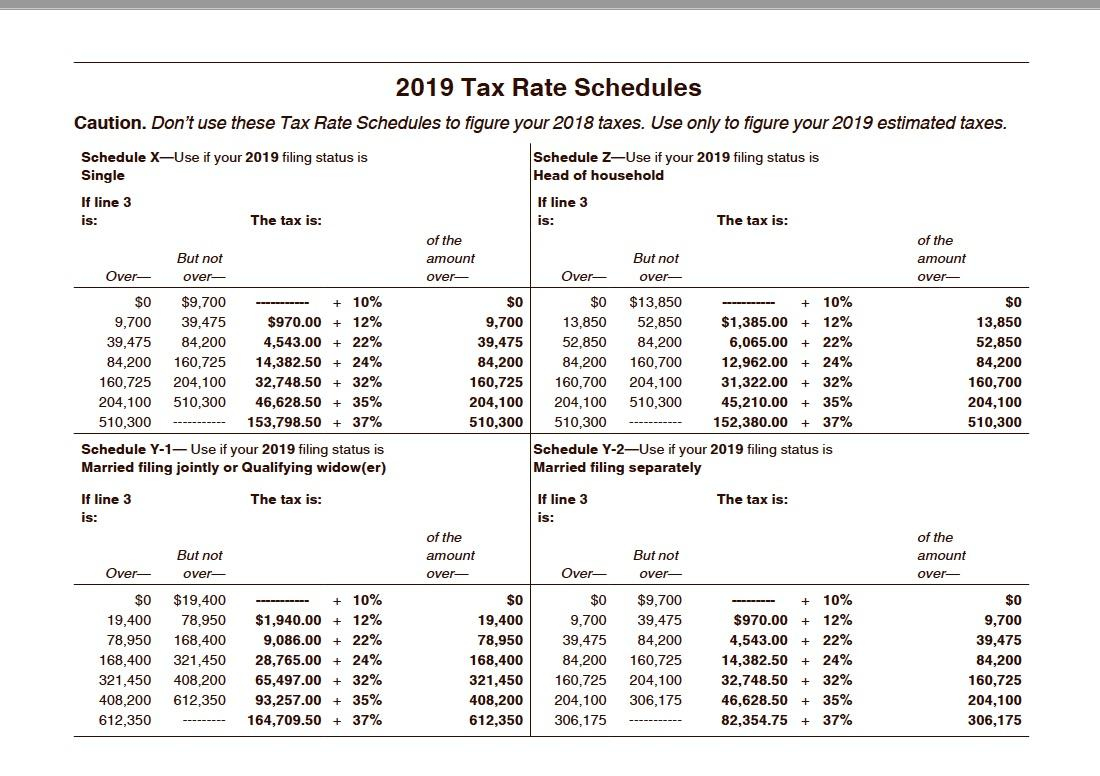

Irs Estimated Tax Worksheet 2024 Fae Letisha

Enter your expenses for medical, charity,. This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) State and local sales tax deduction worksheet note: Download or print the 2024 federal (itemized deductions) (2024) and other.

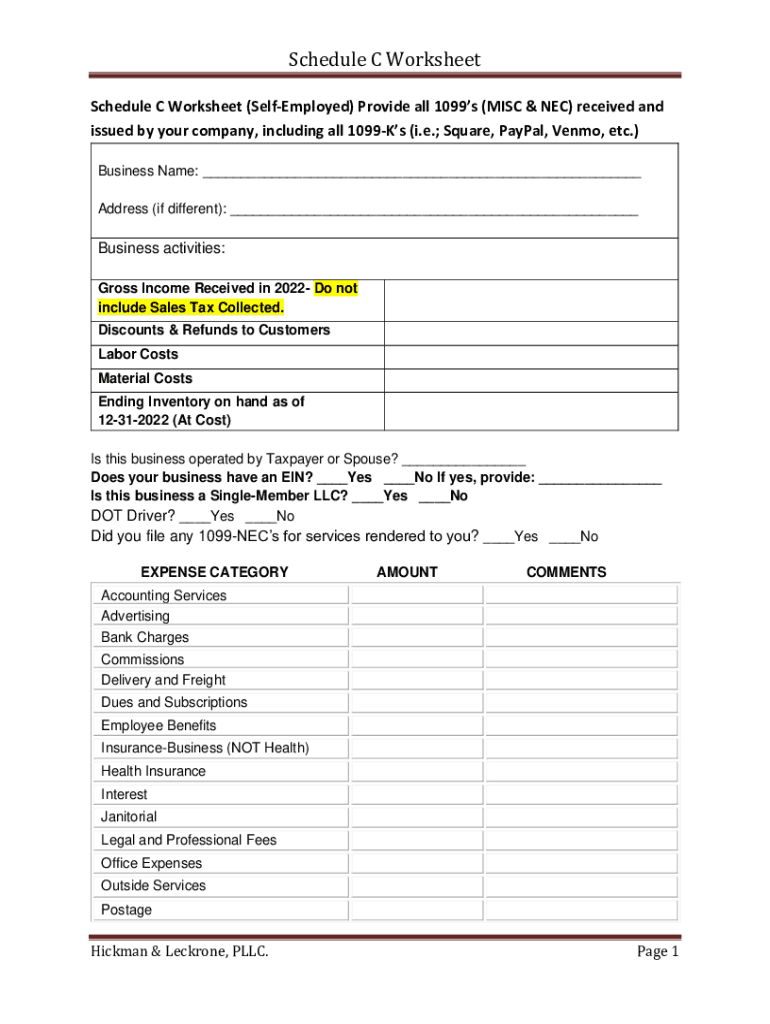

20222024 Form TX Hickman & Leckrone Schedule C Worksheet Fill

See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) Download and complete this worksheet to calculate your itemized deductions for tax year 2024. This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical.

Free printable class schedule templates to customize Canva

Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. Download and complete this worksheet to calculate your itemized.

Capital Loss Carryover 2024

Go to www.irs.gov/schedulea for instructions and the latest information. This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. See the schedule a instructions if taxpayer lived in more.

Free Monthly Work Schedule Template (2024 Version) Homebase

Enter your expenses for medical, charity,. 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. Go to www.irs.gov/schedulea for instructions and the latest information. State and local sales tax deduction worksheet note:

State And Local Sales Tax Deduction Worksheet Note:

Download and complete this worksheet to calculate your itemized deductions for tax year 2024. Enter your expenses for medical, charity,. See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local.

Download Or Print The 2024 Federal (Itemized Deductions) (2024) And Other Income Tax Forms From The Federal Internal Revenue Service.

Go to www.irs.gov/schedulea for instructions and the latest information. 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200)