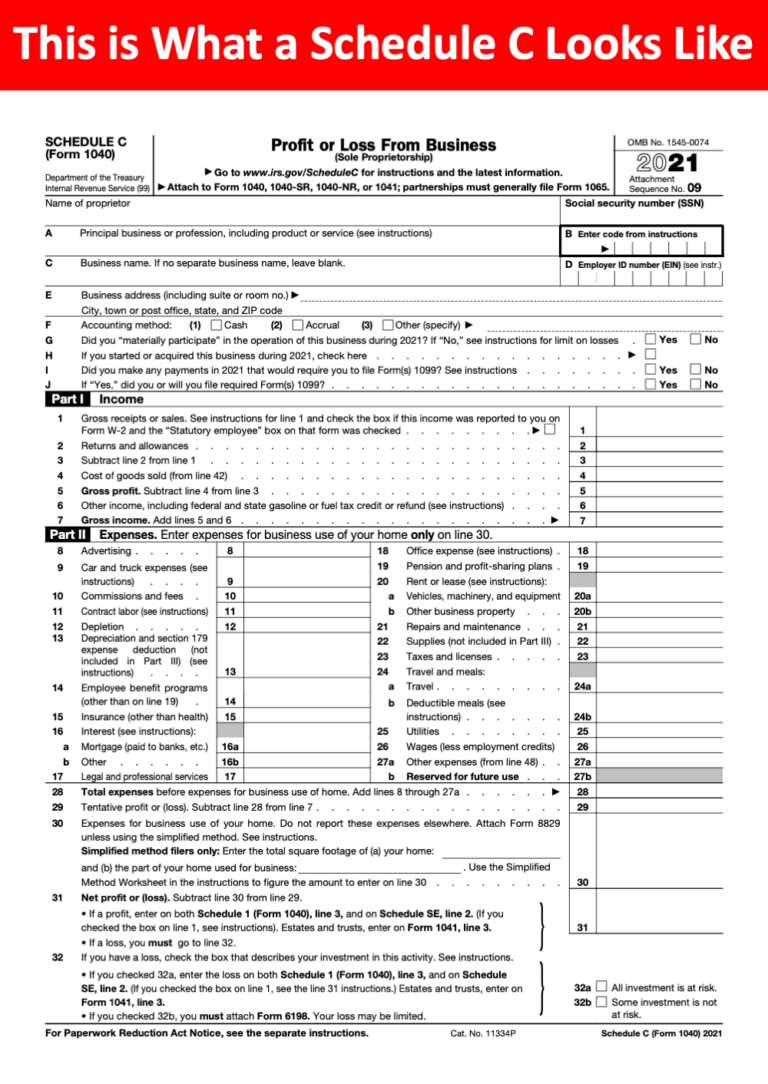

Schedule C 2024 Free Printable - Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. (if you checked the box on. If yes, did you file. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.

Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. If yes, did you file.

Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. If yes, did you file. (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal.

2024 Schedule C Form Orel Tracey

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Payments of $600 or more were paid to an individual, who is not your employee, for services provided.

Irs Schedule C 2024 Tove Ainslie

(if you checked the box on. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Schedule c worksheet for self employed businesses and/or independent contractors.

Irs Fillable Forms 2024 Schedule C Penny Blondell

Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule.

2024 Irs Schedule C 2024 Calendar Template Excel

Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. (if you checked the box on. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. • if you checked 32a, enter the loss on both schedule 1.

Schedule C Printable Guide

Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and.

Schedule C Deductions 2024 Form Nita Terese

(if you checked the box on. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. If yes, did you file. Payments of $600 or more were paid.

2024 Schedule C Form Orel Tracey

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax.

Irs Schedule C Instructions For 2024 Printable Deena Eveleen

(if you checked the box on. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. If yes, did you file. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Payments of $600 or more.

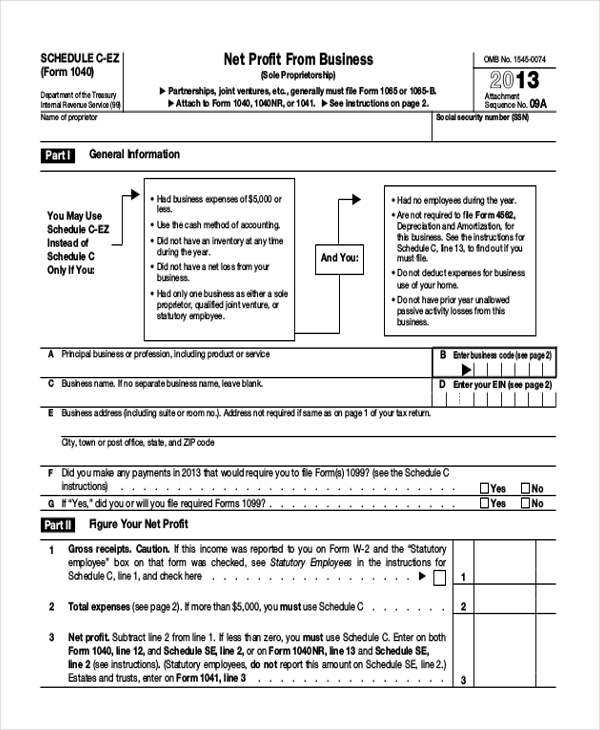

2024 Schedule C Or CEz Schedule C 2024

Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. If yes, did you file. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Payments of $600 or more were paid to an individual, who.

Free Printable Schedule C Tax Form

If yes, did you file. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Download or print the 2024 federal (profit.

If Yes, Did You File.

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal.