Schedule C 2024 Instructions Pdf - Follow the instructions and enter your. See the instructions for the schedules for more. Learn how to complete the irs schedule c form for the 2024 tax year, which reports profit or loss from a business operated as a sole. Find the latest updates, pdf, and ebook versions of the instructions for schedule c (form 1040), used to report income or loss from a sole. Below is a general guide to which schedule(s) you will need to le based on your circumstances. Download and print the official form for reporting profit or loss from business (sole proprietorship) in 2024.

Follow the instructions and enter your. Download and print the official form for reporting profit or loss from business (sole proprietorship) in 2024. Below is a general guide to which schedule(s) you will need to le based on your circumstances. See the instructions for the schedules for more. Find the latest updates, pdf, and ebook versions of the instructions for schedule c (form 1040), used to report income or loss from a sole. Learn how to complete the irs schedule c form for the 2024 tax year, which reports profit or loss from a business operated as a sole.

Below is a general guide to which schedule(s) you will need to le based on your circumstances. Learn how to complete the irs schedule c form for the 2024 tax year, which reports profit or loss from a business operated as a sole. Find the latest updates, pdf, and ebook versions of the instructions for schedule c (form 1040), used to report income or loss from a sole. See the instructions for the schedules for more. Download and print the official form for reporting profit or loss from business (sole proprietorship) in 2024. Follow the instructions and enter your.

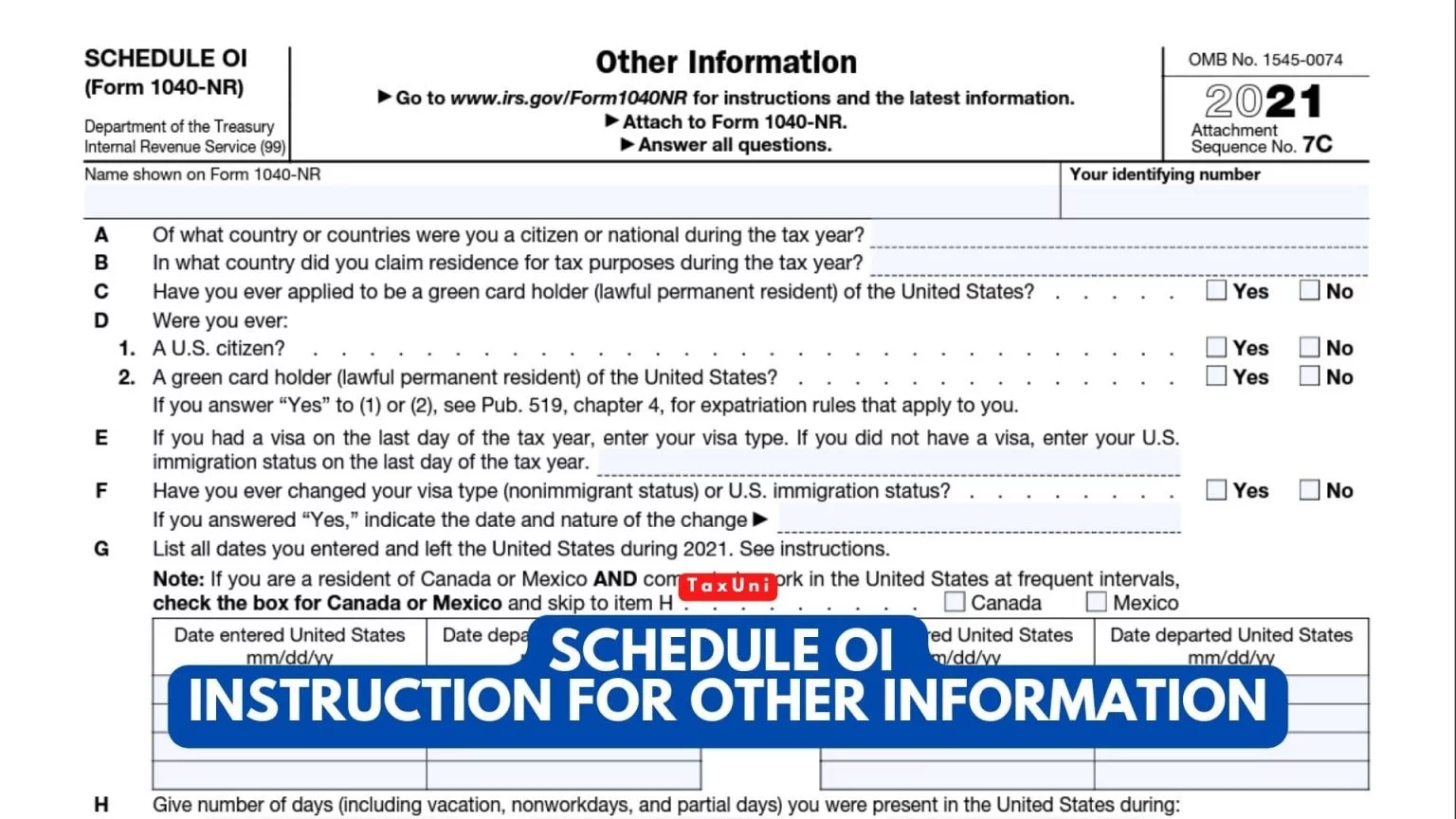

Instructions For Schedule C 2024 Emmy Sissie

Follow the instructions and enter your. Find the latest updates, pdf, and ebook versions of the instructions for schedule c (form 1040), used to report income or loss from a sole. Below is a general guide to which schedule(s) you will need to le based on your circumstances. See the instructions for the schedules for more. Learn how to complete.

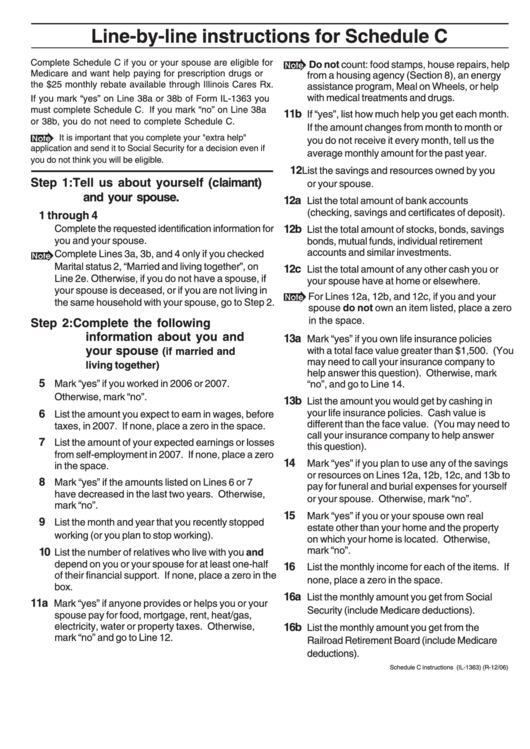

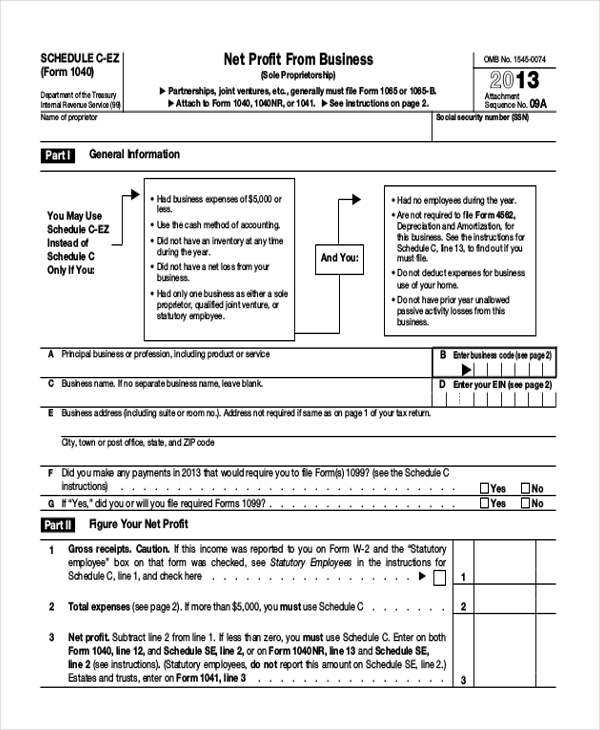

2024 Schedule C Or CEz Schedule C 2024

Find the latest updates, pdf, and ebook versions of the instructions for schedule c (form 1040), used to report income or loss from a sole. Learn how to complete the irs schedule c form for the 2024 tax year, which reports profit or loss from a business operated as a sole. Below is a general guide to which schedule(s) you.

Irs Schedule C Instructions 2024 Lenka Nicolea

Learn how to complete the irs schedule c form for the 2024 tax year, which reports profit or loss from a business operated as a sole. Below is a general guide to which schedule(s) you will need to le based on your circumstances. Download and print the official form for reporting profit or loss from business (sole proprietorship) in 2024..

2024 Schedule C Form Tine Stephenie

Download and print the official form for reporting profit or loss from business (sole proprietorship) in 2024. Below is a general guide to which schedule(s) you will need to le based on your circumstances. Find the latest updates, pdf, and ebook versions of the instructions for schedule c (form 1040), used to report income or loss from a sole. See.

Schedule C Instructions 2024 Pdf Download Roxy Catarina

Follow the instructions and enter your. Below is a general guide to which schedule(s) you will need to le based on your circumstances. See the instructions for the schedules for more. Learn how to complete the irs schedule c form for the 2024 tax year, which reports profit or loss from a business operated as a sole. Find the latest.

2024 Schedule C Alia Louise

Download and print the official form for reporting profit or loss from business (sole proprietorship) in 2024. Find the latest updates, pdf, and ebook versions of the instructions for schedule c (form 1040), used to report income or loss from a sole. See the instructions for the schedules for more. Learn how to complete the irs schedule c form for.

Schedule C Instructions 2024 Pdf Download Roxy Catarina

Download and print the official form for reporting profit or loss from business (sole proprietorship) in 2024. Learn how to complete the irs schedule c form for the 2024 tax year, which reports profit or loss from a business operated as a sole. Follow the instructions and enter your. Below is a general guide to which schedule(s) you will need.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Follow the instructions and enter your. Learn how to complete the irs schedule c form for the 2024 tax year, which reports profit or loss from a business operated as a sole. See the instructions for the schedules for more. Find the latest updates, pdf, and ebook versions of the instructions for schedule c (form 1040), used to report income.

Instructions For Schedule C 2024 Emmy Sissie

Learn how to complete the irs schedule c form for the 2024 tax year, which reports profit or loss from a business operated as a sole. See the instructions for the schedules for more. Download and print the official form for reporting profit or loss from business (sole proprietorship) in 2024. Find the latest updates, pdf, and ebook versions of.

Schedule C Instructions 2024 Instructions Ivett Letisha

Find the latest updates, pdf, and ebook versions of the instructions for schedule c (form 1040), used to report income or loss from a sole. Download and print the official form for reporting profit or loss from business (sole proprietorship) in 2024. Follow the instructions and enter your. See the instructions for the schedules for more. Below is a general.

Download And Print The Official Form For Reporting Profit Or Loss From Business (Sole Proprietorship) In 2024.

Below is a general guide to which schedule(s) you will need to le based on your circumstances. Learn how to complete the irs schedule c form for the 2024 tax year, which reports profit or loss from a business operated as a sole. See the instructions for the schedules for more. Find the latest updates, pdf, and ebook versions of the instructions for schedule c (form 1040), used to report income or loss from a sole.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)