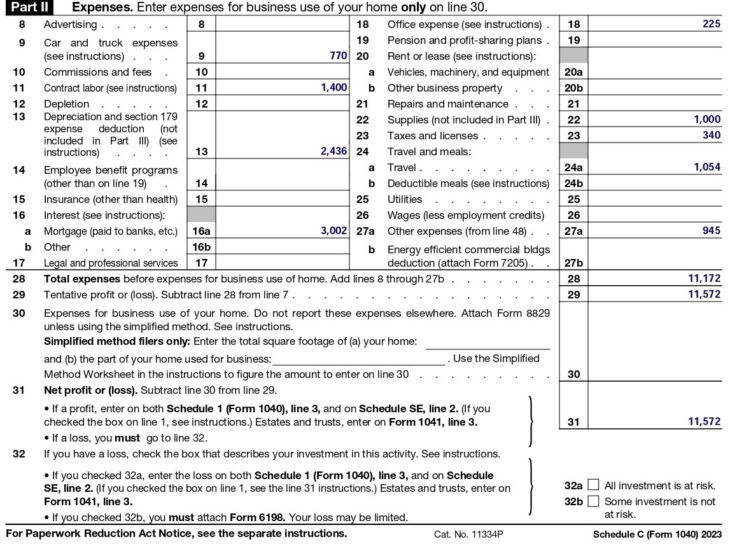

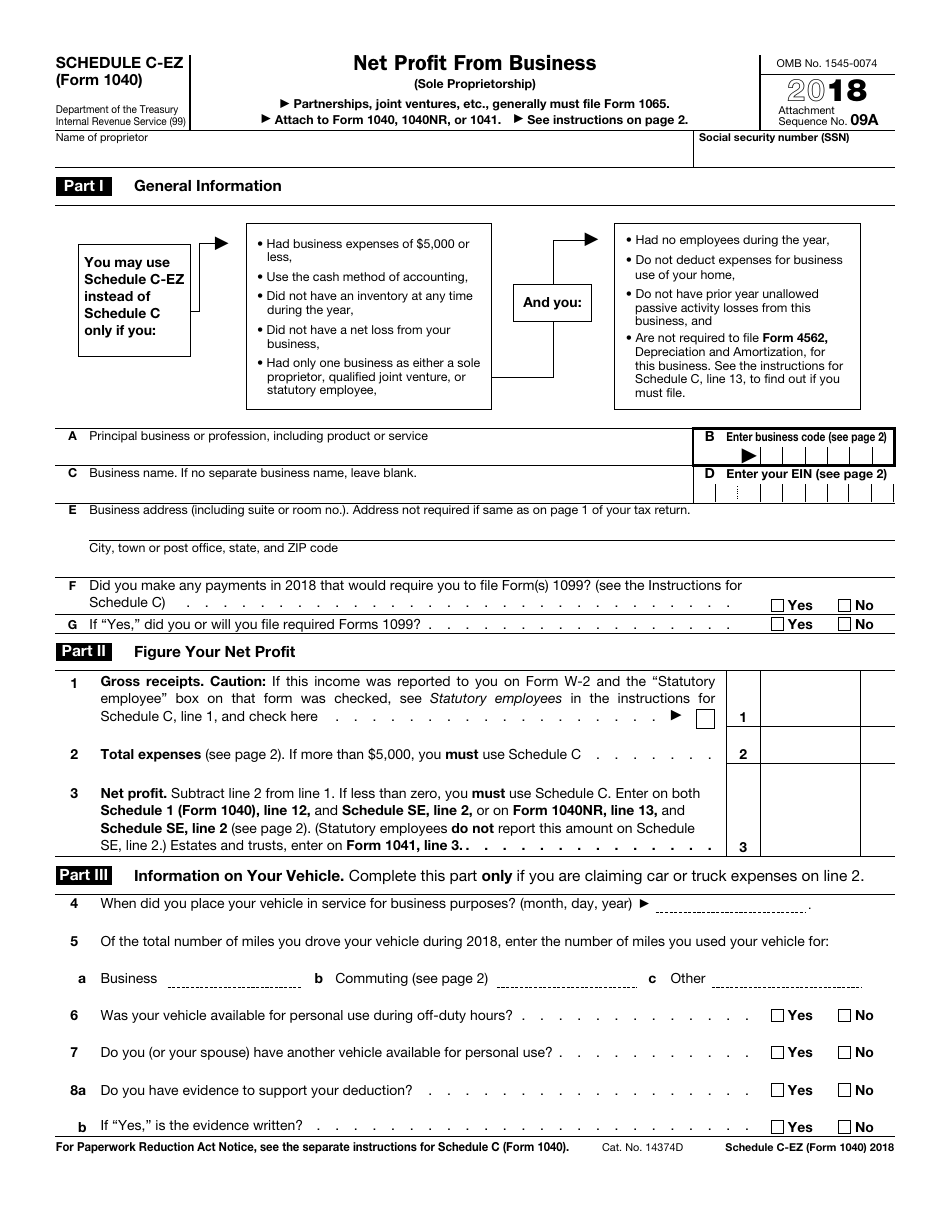

Schedule C Fillable Form 2024 - (if you checked the box on. Profit or loss from business (sch. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 1m+ visitors in the past month 51business income (schedule c) (cont.) • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 1m+ visitors in the past month 51business income (schedule c) (cont.) (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Profit or loss from business (sch.

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. 51business income (schedule c) (cont.) (if you checked the box on. Profit or loss from business (sch. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 1m+ visitors in the past month

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

51business income (schedule c) (cont.) 1m+ visitors in the past month The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Profit or loss from business (sch. (if you checked the box on.

Irs Form 2024 Schedule C 2024 gayel gilligan

1m+ visitors in the past month The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. Profit or.

Irs Fillable Forms 2024 Schedule C Penny Blondell

1m+ visitors in the past month (if you checked the box on. Profit or loss from business (sch. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.)

Irs Fillable Forms 2024 Schedule C Micki Stormie

(if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.) Profit or loss from business (sch. 1m+ visitors in the past month

2024 Schedule C Form Orel Tracey

51business income (schedule c) (cont.) (if you checked the box on. Profit or loss from business (sch. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses.

2024 Schedule C Form Maren Florentia

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.) Profit or loss from business (sch. 1m+ visitors in the past month (if you checked the box on.

How To Fill Out Schedule C in 2024 (With Example)

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Profit or loss from business (sch. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. 51business income (schedule c) (cont.) (if you checked.

Irs 2024 Form 1040 Schedule C Tasha Fredelia

1m+ visitors in the past month 51business income (schedule c) (cont.) • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. Profit or loss from business (sch.

2024 Irs Schedule C 2024 Calendar Template Excel

51business income (schedule c) (cont.) Profit or loss from business (sch. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. (if you checked.

Irs Schedule C 2024 Tove Ainslie

1m+ visitors in the past month 51business income (schedule c) (cont.) • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. (if you checked.

Profit Or Loss From Business (Sch.

1m+ visitors in the past month The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.) (if you checked the box on.