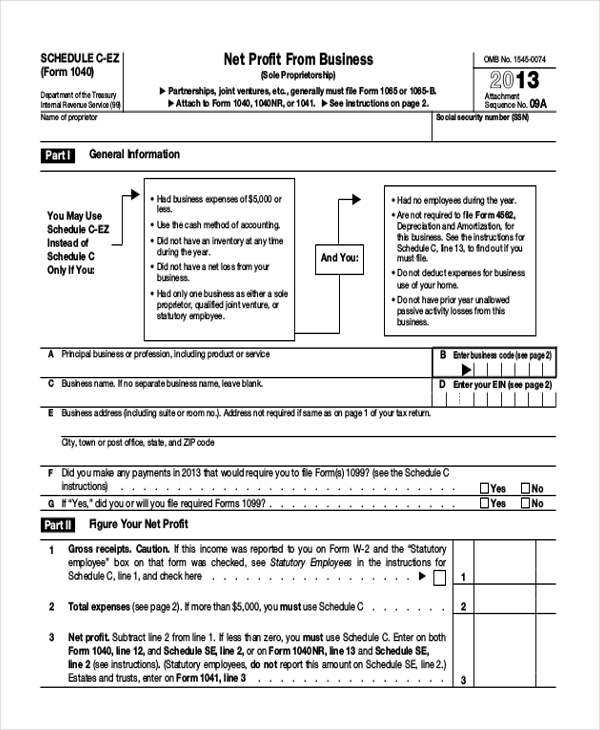

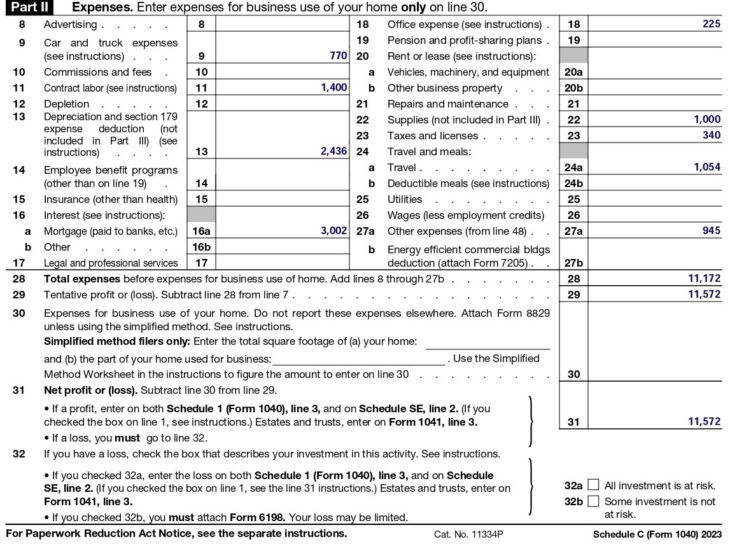

Schedule C Pdf 2024 - For use schedule c (form. Select if this business is for: Preparer use only 2024 information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Business address, if different from home address on organizer form id: Cash accrual employer id number other (specify) this business started or was acquired during 2024. 51business income (schedule c) (cont.) Asset acquisition list (please list all assets you have purchased or placed in service in 2024.)

For use schedule c (form. Select if this business is for: 51business income (schedule c) (cont.) Asset acquisition list (please list all assets you have purchased or placed in service in 2024.) Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Preparer use only 2024 information. Business address, if different from home address on organizer form id: Cash accrual employer id number other (specify) this business started or was acquired during 2024. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule.

For use schedule c (form. Preparer use only 2024 information. Cash accrual employer id number other (specify) this business started or was acquired during 2024. Asset acquisition list (please list all assets you have purchased or placed in service in 2024.) Select if this business is for: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. 51business income (schedule c) (cont.) Business address, if different from home address on organizer form id:

2024 Schedule C Form 1040 Forms Lissa Phillis

Business address, if different from home address on organizer form id: Cash accrual employer id number other (specify) this business started or was acquired during 2024. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. 51business income (schedule c) (cont.) Preparer use only 2024 information.

2024 Irs Schedule C 2024 Calendar Template Excel

Cash accrual employer id number other (specify) this business started or was acquired during 2024. Asset acquisition list (please list all assets you have purchased or placed in service in 2024.) Preparer use only 2024 information. Select if this business is for: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support.

Schedule C Instructions 2024 Instructions Ivett Letisha

Asset acquisition list (please list all assets you have purchased or placed in service in 2024.) For use schedule c (form. 51business income (schedule c) (cont.) Cash accrual employer id number other (specify) this business started or was acquired during 2024. Business address, if different from home address on organizer form id:

Schedule C Tax Form 2024 Libbi Roseanne

Business address, if different from home address on organizer form id: 51business income (schedule c) (cont.) Select if this business is for: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from.

2024 Schedule C Or CEz Schedule C 2024

For use schedule c (form. Cash accrual employer id number other (specify) this business started or was acquired during 2024. Asset acquisition list (please list all assets you have purchased or placed in service in 2024.) Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule.

Schedule C Instructions 2024 Pdf Download Roxy Catarina

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Cash accrual employer id number other (specify) this business started or was acquired during 2024. Select if.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Cash accrual employer id number other (specify) this business started or was acquired during 2024. Business address, if different from home address on organizer form id: For use schedule c (form. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Information about schedule c (form 1040), profit or loss.

How To Fill Out Schedule C in 2024 (With Example)

51business income (schedule c) (cont.) Cash accrual employer id number other (specify) this business started or was acquired during 2024. Select if this business is for: Business address, if different from home address on organizer form id: Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

Download Fillable Schedule C Form

Select if this business is for: Business address, if different from home address on organizer form id: Cash accrual employer id number other (specify) this business started or was acquired during 2024. For use schedule c (form. 51business income (schedule c) (cont.)

Irs Fillable Forms 2024 Schedule C Penny Blondell

Business address, if different from home address on organizer form id: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Asset acquisition list (please list all.

Information About Schedule C (Form 1040), Profit Or Loss From Business, Used To Report Income Or Loss From A Business Operated Or Profession.

Cash accrual employer id number other (specify) this business started or was acquired during 2024. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. For use schedule c (form. 51business income (schedule c) (cont.)

Asset Acquisition List (Please List All Assets You Have Purchased Or Placed In Service In 2024.)

Preparer use only 2024 information. Select if this business is for: Business address, if different from home address on organizer form id: