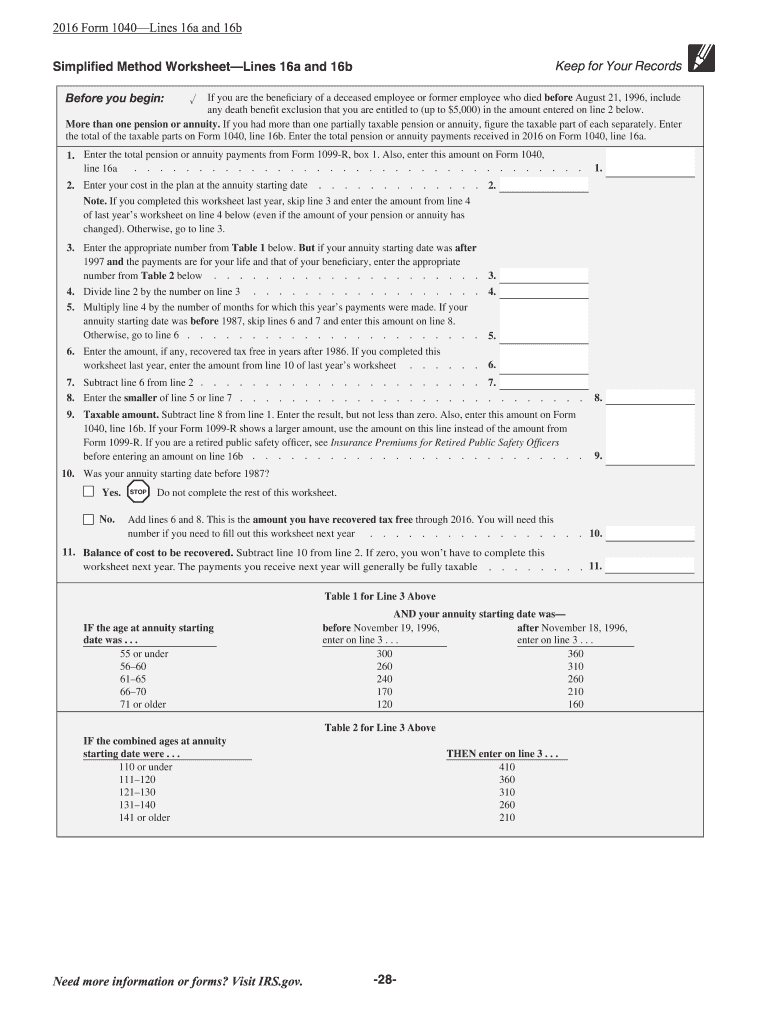

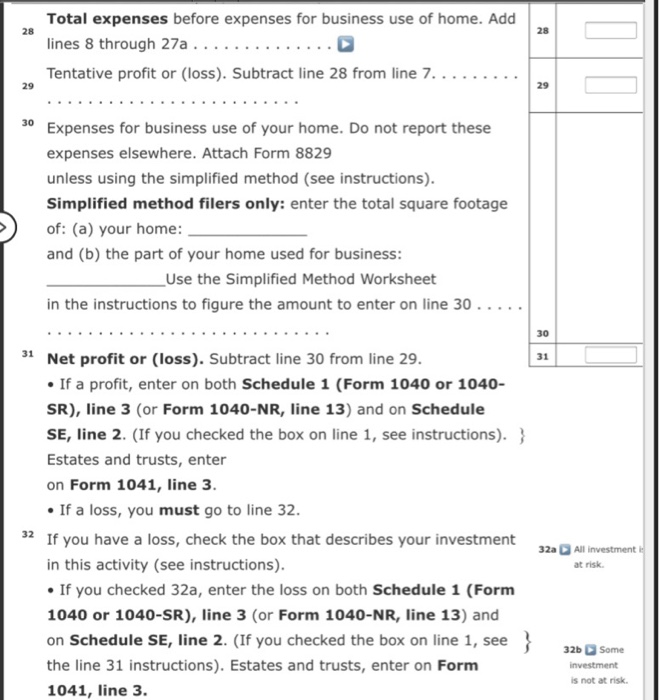

Schedule C Simplified Method Worksheet 2024 - Cash accrual employer id number. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Use the simplified method worksheet in these instructions to figure your deduction for a qualified business use of your home if you are electing. (if you checked the box on. Professional product or service business name business address, city, state, zip accounting method: You need to download and print the detail from each company’s web site. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction.

10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. (if you checked the box on. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Cash accrual employer id number. You need to download and print the detail from each company’s web site. Professional product or service business name business address, city, state, zip accounting method: Use the simplified method worksheet in these instructions to figure your deduction for a qualified business use of your home if you are electing. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.

Use the simplified method worksheet in these instructions to figure your deduction for a qualified business use of your home if you are electing. Cash accrual employer id number. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. You need to download and print the detail from each company’s web site. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. (if you checked the box on. Professional product or service business name business address, city, state, zip accounting method:

Simplified Method Worksheet Schedule C

Professional product or service business name business address, city, state, zip accounting method: You need to download and print the detail from each company’s web site. 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Use the simplified method worksheet in these instructions to figure your deduction for a qualified business use of your home.

Simplified Method Worksheet Schedule C

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Professional product or service business name business address, city, state, zip accounting method: • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. 10 rows it merely simplifies.

Schedule C Simplified Method Worksheet

Cash accrual employer id number. Use the simplified method worksheet in these instructions to figure your deduction for a qualified business use of your home if you are electing. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. (if you checked the box on. 10 rows it merely simplifies.

8829 Simplified Method (ScheduleC, ScheduleF) Worksheets Library

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. You need to download and print the detail from each company’s web site. (if you checked the box on. Use the simplified method worksheet in these.

Simplified Method Worksheet

10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. You need to download and print the detail from each company’s web site. Professional product or service business name business address, city, state, zip accounting method:.

Simplified Method Worksheet Schedule C

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. You need to download and print the detail from each company’s web site. Use the simplified method worksheet in these instructions to figure your deduction for a qualified business use of your home if you are electing. 10 rows it.

Schedule C Deductions 2024 Form Nita Terese

Use the simplified method worksheet in these instructions to figure your deduction for a qualified business use of your home if you are electing. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. You need to download and print the detail.

Simplified Method Worksheet Schedule C

You need to download and print the detail from each company’s web site. 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Use the simplified method worksheet in these instructions to figure your deduction for.

Schedule C Simplified Method Worksheet

(if you checked the box on. Professional product or service business name business address, city, state, zip accounting method: Use the simplified method worksheet in these instructions to figure your deduction for a qualified business use of your home if you are electing. Cash accrual employer id number. • if you checked 32a, enter the loss on both schedule 1.

Schedule C Simplified Method Worksheets

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Cash accrual employer id number. 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Use the simplified method worksheet in these instructions to figure your deduction for a qualified business use of your.

(If You Checked The Box On.

Professional product or service business name business address, city, state, zip accounting method: Cash accrual employer id number. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Use the simplified method worksheet in these instructions to figure your deduction for a qualified business use of your home if you are electing.

You Need To Download And Print The Detail From Each Company’s Web Site.

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction.