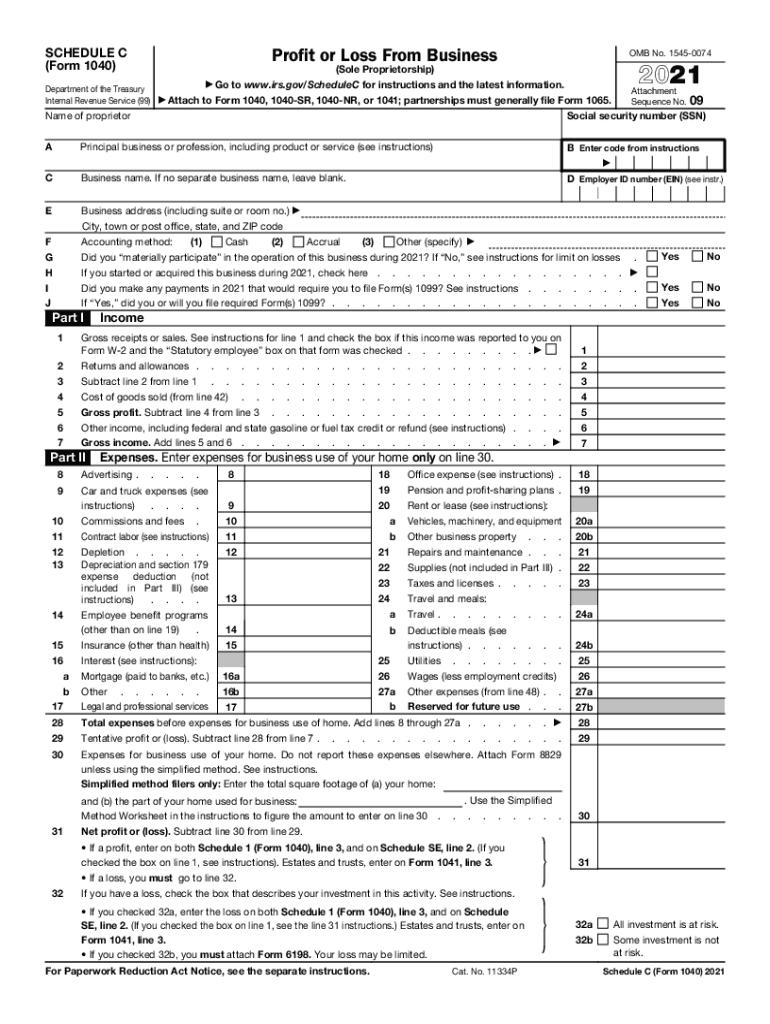

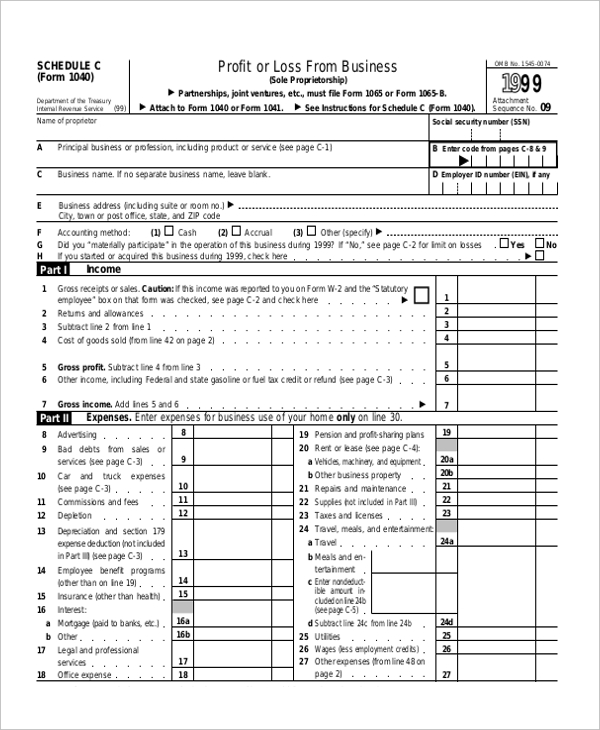

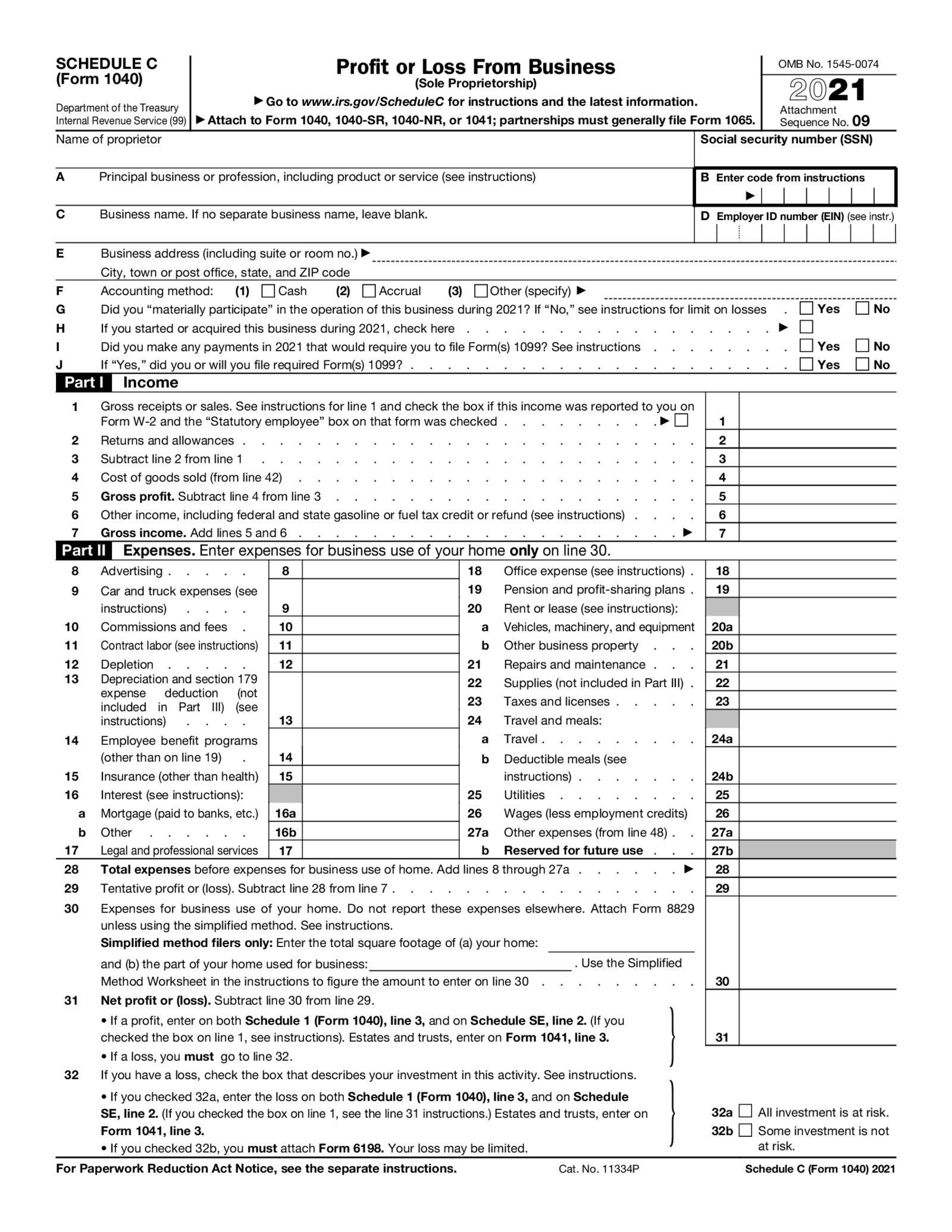

Schedule C Tax Form Printable 2021 - To fill out schedule c, gather your business records and relevant income data. Start by entering basic information about your business. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Go to www.freetaxusa.com to start your free return today! A collection of relevant forms and publications related to understanding and fulfilling your filing requirements.

Start by entering basic information about your business. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Go to www.freetaxusa.com to start your free return today! Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. To fill out schedule c, gather your business records and relevant income data.

A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. To fill out schedule c, gather your business records and relevant income data. Start by entering basic information about your business. Go to www.freetaxusa.com to start your free return today!

Printable Schedule C

A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Start by.

Schedule c tax form fleetqust

Start by entering basic information about your business. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.freetaxusa.com to start your free return today! A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. To fill out schedule c,.

Download Fillable Schedule C Form

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Start by.

Printable Schedule C Form

To fill out schedule c, gather your business records and relevant income data. Go to www.freetaxusa.com to start your free return today! Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Start by entering basic information about your business. A collection of relevant forms and publications.

2021 Form IRS 1040 Schedule C Fill Online, Printable, Fillable, Blank

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Start by entering basic information about your business. Use schedule c to report income or loss from a business or profession in.

2021 Form IRS Instructions 1040 Schedule C Fill Online, Printable

Start by entering basic information about your business. Go to www.freetaxusa.com to start your free return today! Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor..

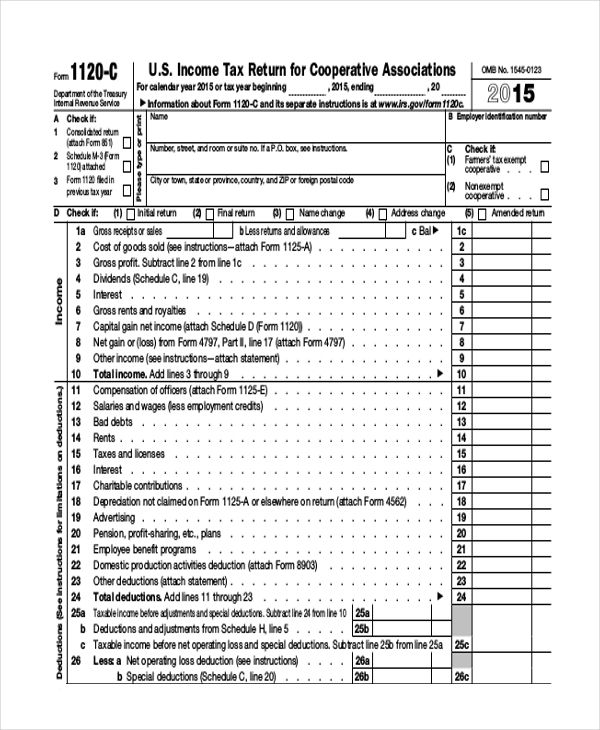

FREE 9+ Sample Schedule C Forms in PDF MS Word

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.freetaxusa.com to start your free return today! Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. A collection of relevant forms and publications related.

Fillable SCHEDULE C (Form 1040) (2021), sign form PDFliner

Go to www.freetaxusa.com to start your free return today! To fill out schedule c, gather your business records and relevant income data. Start by entering basic information about your business. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Information about schedule c (form 1040), profit or loss from business, used to report income.

Schedule C Tax Form Printable

Start by entering basic information about your business. To fill out schedule c, gather your business records and relevant income data. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Go to www.freetaxusa.com to.

Free Printable Schedule C Tax Form

Start by entering basic information about your business. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Go to www.freetaxusa.com to start your free return today!.

Go To Www.freetaxusa.com To Start Your Free Return Today!

To fill out schedule c, gather your business records and relevant income data. Start by entering basic information about your business. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements.