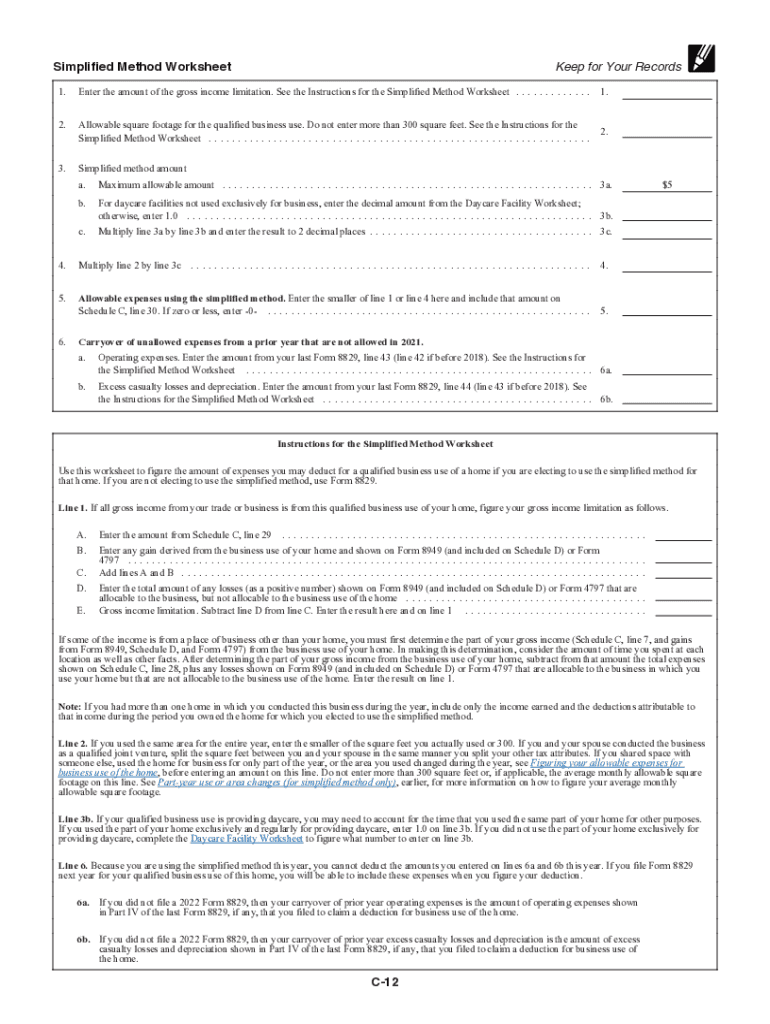

Schedule C Worksheet 2022 - 2022 schedule c simplified method worksheet keep for your records note: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Be sure you have with you today: Attached is a blank worksheet if this is a new factor in your tax situation. Net profit or (loss) buildings and machinery sold outright (no trades): Please refer to the instructions for the simplified. 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your.

Be sure you have with you today: Attached is a blank worksheet if this is a new factor in your tax situation. Please refer to the instructions for the simplified. 2022 schedule c simplified method worksheet keep for your records note: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Net profit or (loss) buildings and machinery sold outright (no trades):

Please refer to the instructions for the simplified. 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. 2022 schedule c simplified method worksheet keep for your records note: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Net profit or (loss) buildings and machinery sold outright (no trades): Attached is a blank worksheet if this is a new factor in your tax situation. Be sure you have with you today:

Schedule c expenses worksheet Fill out & sign online DocHub

Net profit or (loss) buildings and machinery sold outright (no trades): 2022 schedule c simplified method worksheet keep for your records note: Attached is a blank worksheet if this is a new factor in your tax situation. Be sure you have with you today: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file.

Free Printable Schedule C Tax Form

Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Please refer to the instructions for the simplified. 2022 schedule c simplified method worksheet keep for your records note: Be sure you have with you today:

Schedule C Printable Guide

Be sure you have with you today: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Attached is a blank worksheet if this is a.

How To Fill Out Your 2022 Schedule C (With Example)

2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Net profit or (loss) buildings and machinery sold outright (no trades): 2022 schedule c simplified method worksheet keep for your records note: Please refer to the instructions for the simplified. Be sure you have with you.

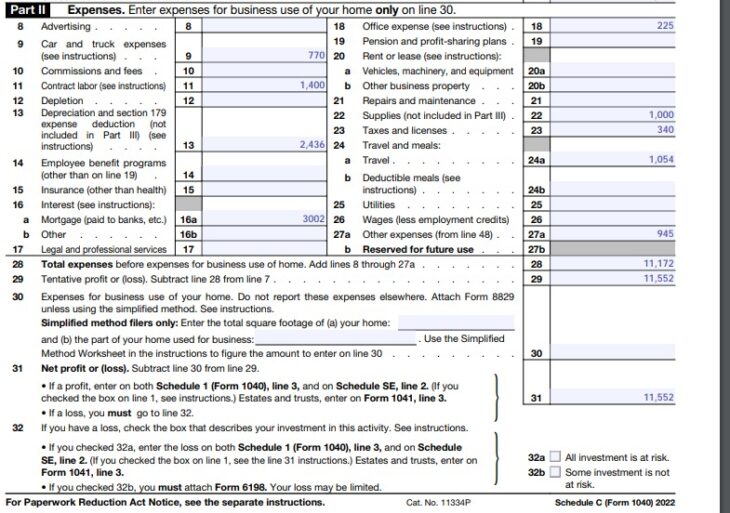

IRS Form 1040 Schedule C (2022) Profit or Loss From Business

Net profit or (loss) buildings and machinery sold outright (no trades): Please refer to the instructions for the simplified. Be sure you have with you today: 2022 schedule c simplified method worksheet keep for your records note: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule.

Schedule C Expenses Worksheet 2022

Net profit or (loss) buildings and machinery sold outright (no trades): 2022 schedule c simplified method worksheet keep for your records note: Please refer to the instructions for the simplified. Attached is a blank worksheet if this is a new factor in your tax situation. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

Attached is a blank worksheet if this is a new factor in your tax situation. Please refer to the instructions for the simplified. Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. 2022 schedule c summary worksheet if.

Schedule C Simplified Method Worksheet Printable And Enjoyable Learning

Please refer to the instructions for the simplified. Be sure you have with you today: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Attached is a blank worksheet if this is a new factor in your tax situation. 2022 schedule c summary worksheet if you have your own.

How to Fill Out Your Schedule C Perfectly (With Examples!) Worksheets

Net profit or (loss) buildings and machinery sold outright (no trades): 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Please refer to the instructions for the simplified. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to.

1040 schedule c 2022 form Fill out & sign online DocHub

Please refer to the instructions for the simplified. Be sure you have with you today: Net profit or (loss) buildings and machinery sold outright (no trades): 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Schedule c worksheet for self employed businesses and/or independent contractors.

2022 Schedule C Summary Worksheet If You Have Your Own Business, It Is Important That You Maintain Proper Books And Records Of Both Your.

Net profit or (loss) buildings and machinery sold outright (no trades): 2022 schedule c simplified method worksheet keep for your records note: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Be sure you have with you today:

Please Refer To The Instructions For The Simplified.

Attached is a blank worksheet if this is a new factor in your tax situation.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)