Tracking Business Expenses For Tax Purposes - Tracking business expenses for taxes is a crucial practice that every business owner must master. Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Tracking business expenses for taxes is a crucial practice that every business owner must master.

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Tracking business expenses for taxes is a crucial practice that every business owner must master. Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season.

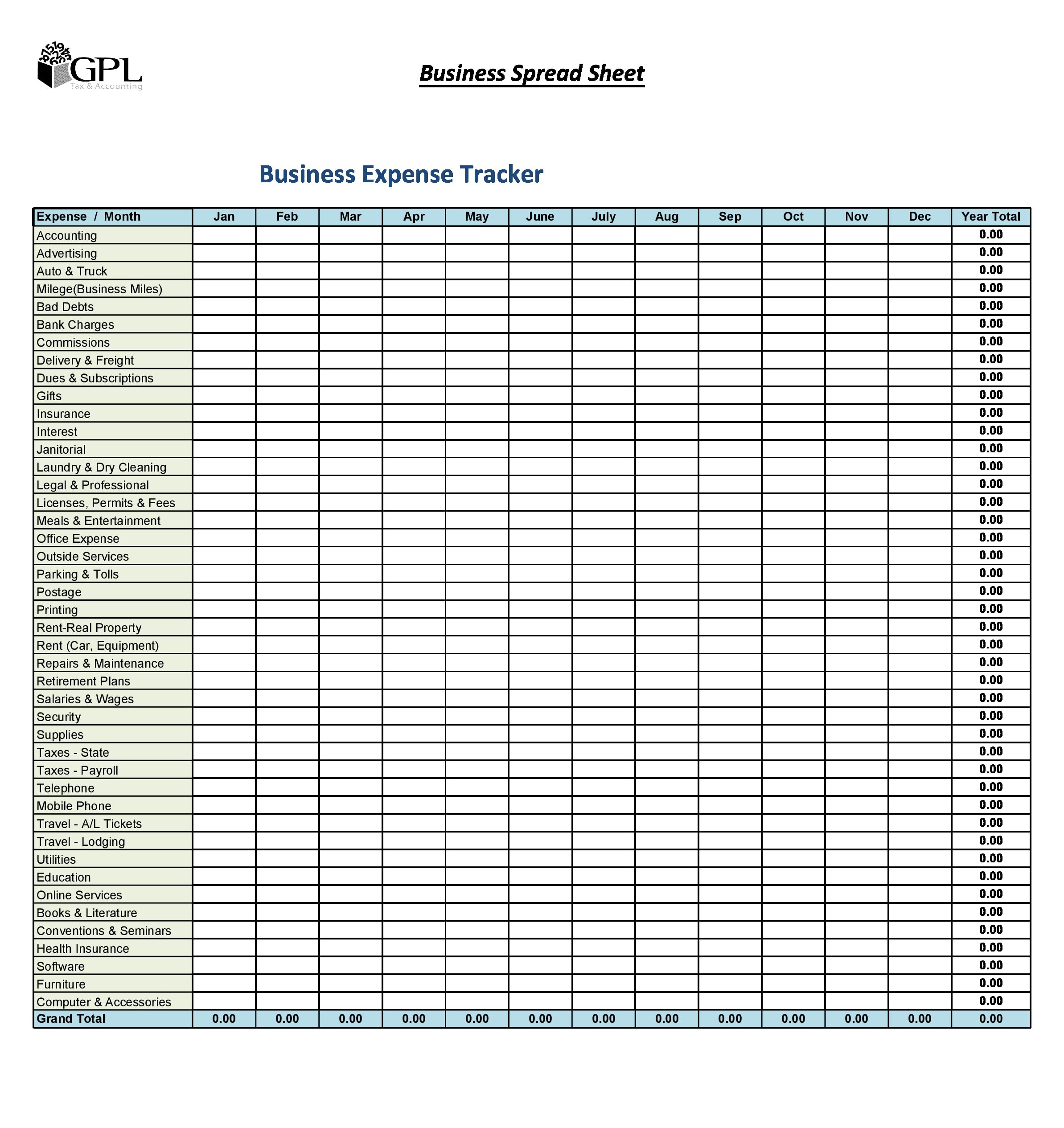

Free Business Expense Tracker Template

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Tracking business expenses for taxes is a crucial practice that every business owner must master. Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season.

Free Business and Expense Tracker in PDF (Colorful) in 2023

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Tracking business expenses for taxes is a crucial practice that every business owner must master. Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season.

How to keep track of business expenses for tax purposes? presentation

Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Tracking business expenses for taxes is a crucial practice that every business owner must master.

Simple spreadsheets to keep track of business and expenses for

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season. Tracking business expenses for taxes is a crucial practice that every business owner must master.

How to Master Expense Tracking for Your Business ExpenseIn Blog

Tracking business expenses for taxes is a crucial practice that every business owner must master. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season.

Free Business Expense Tracking Spreadsheet (2024) Worksheets Library

Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season. Tracking business expenses for taxes is a crucial practice that every business owner must master. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

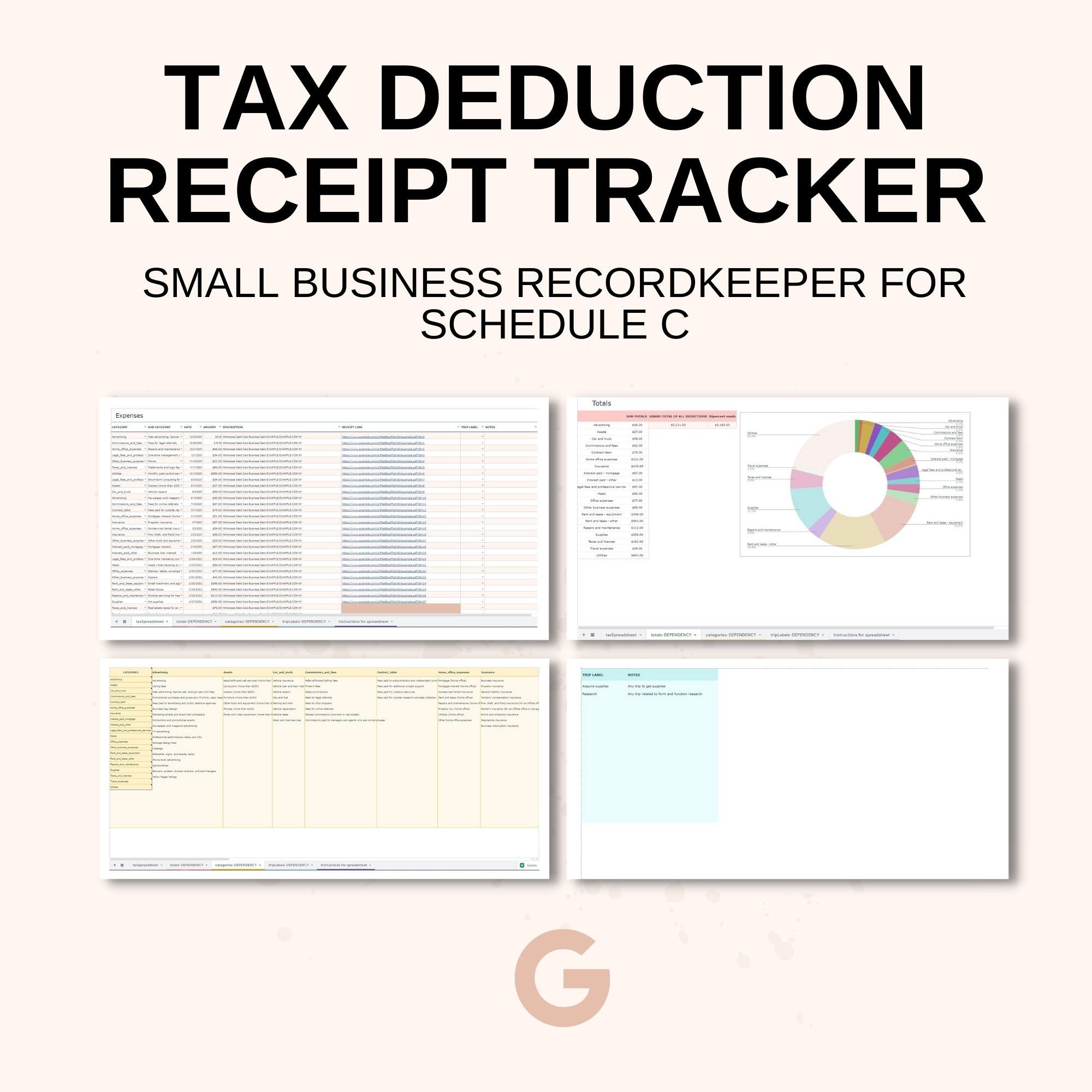

Easy Tax Deduction Receipt Tracker / for Small US Business / Schedule C

Tracking business expenses for taxes is a crucial practice that every business owner must master. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season.

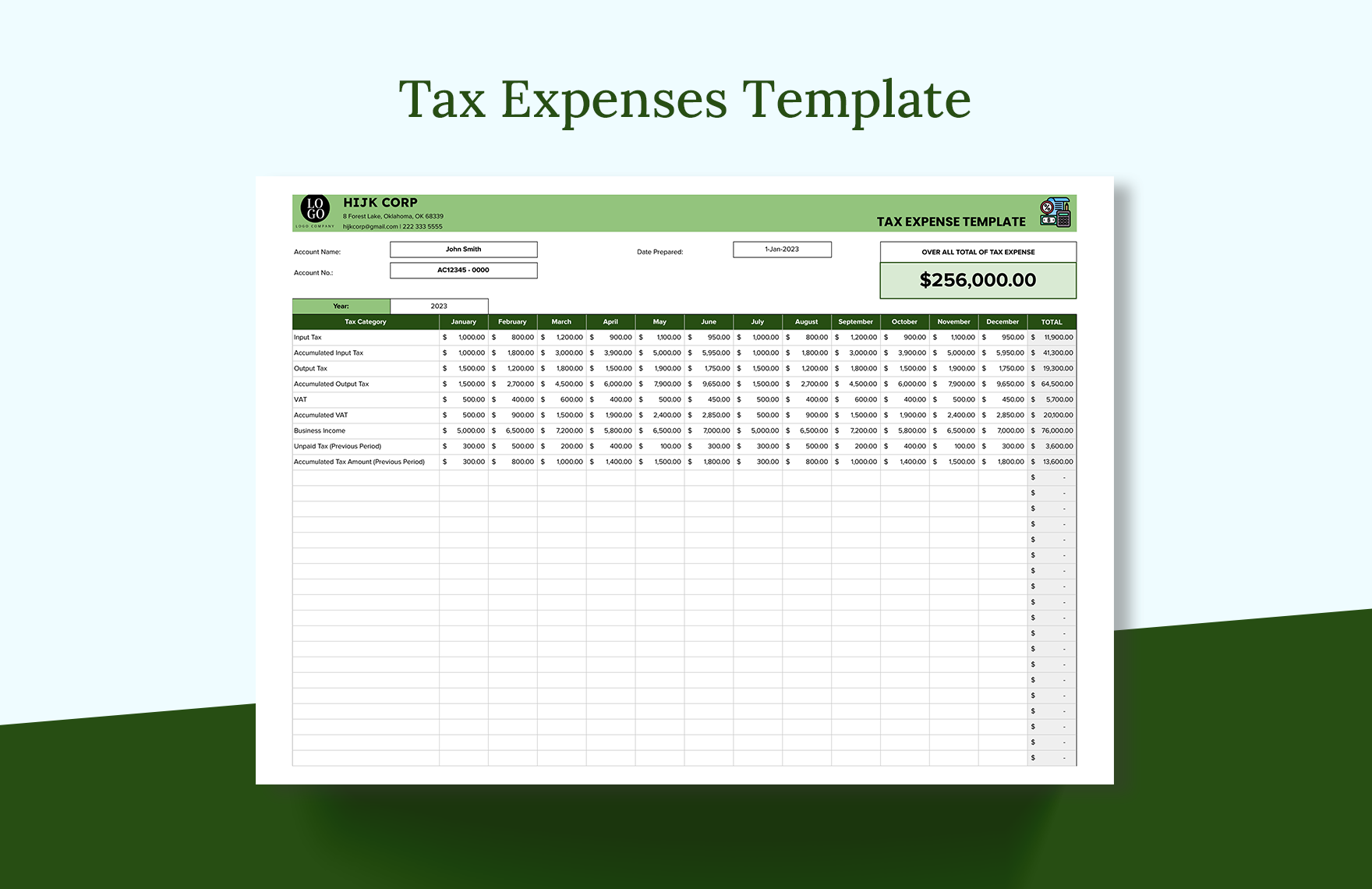

Tax Return On Business Expenses at William Stork blog

Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Tracking business expenses for taxes is a crucial practice that every business owner must master.

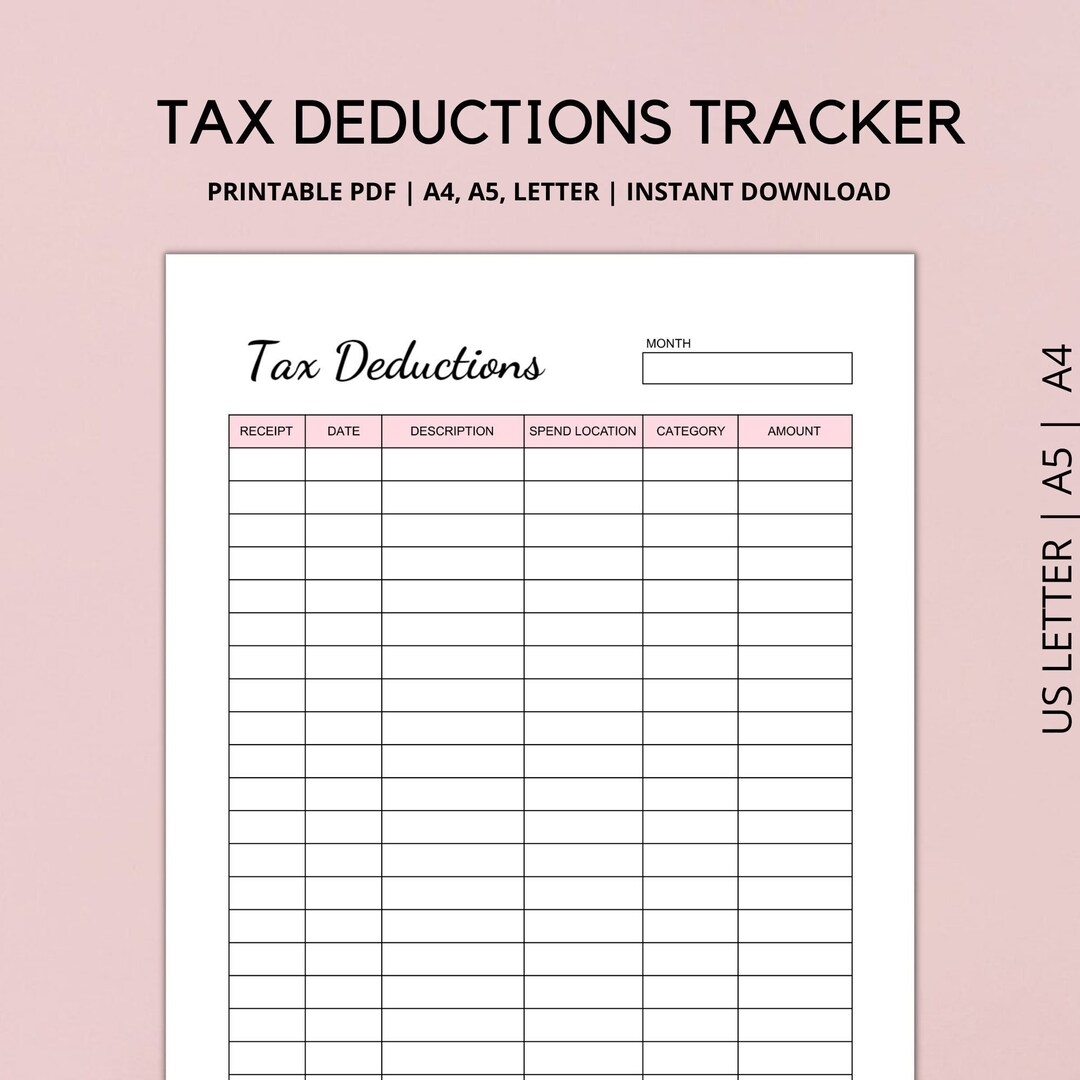

Tax Deduction Tracker Printable, Business Tax Log, Expenses Tracker

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Tracking business expenses for taxes is a crucial practice that every business owner must master. Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season.

Managing Business Expenses For Tax Purposes Excel Template And Google

Tracking business expenses for taxes is a crucial practice that every business owner must master. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season.

Find Out The Kinds Of Records You Should Keep For Your Business To Show Income And Expenses For Federal Tax Purposes.

Tracking business expenses for taxes is a crucial practice that every business owner must master. Without proper expense tracking, you risk overpaying on taxes, missing valuable deductions, and creating headaches during tax season.