Uae Vat Return Filing Guide - Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. You must file for tax return electronically through the fta portal: Filing vat returns on time is essential for ensuring compliance and avoiding penalties. How to file vat return?

Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. How to file vat return? You must file for tax return electronically through the fta portal: Filing vat returns on time is essential for ensuring compliance and avoiding penalties.

How to file vat return? You must file for tax return electronically through the fta portal: Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Filing vat returns on time is essential for ensuring compliance and avoiding penalties.

How to file VAT return in UAE On Emara Tax Portal Step wise guide VAT

You must file for tax return electronically through the fta portal: Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. How to file vat return? Filing vat returns on time is essential for ensuring compliance and avoiding penalties.

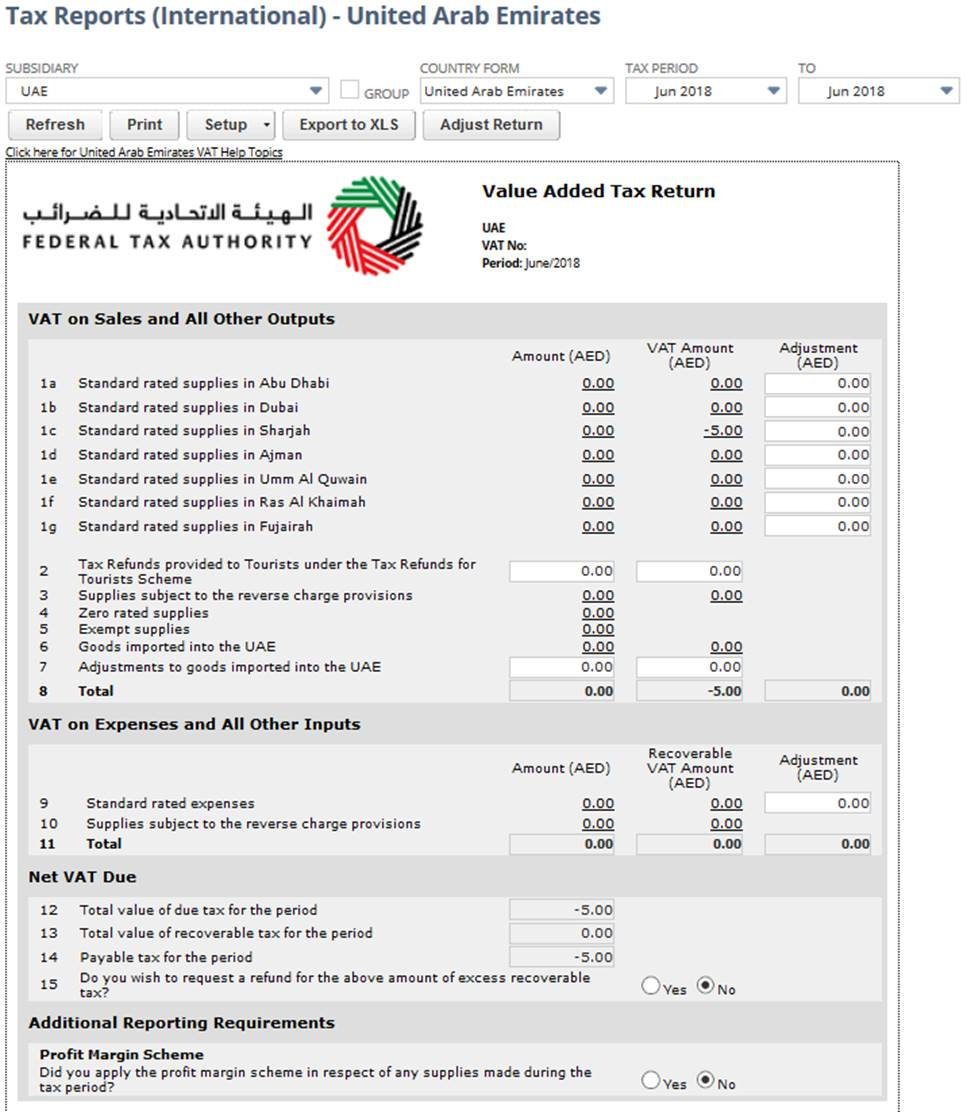

NetSuite Applications Suite United Arab Emirates VAT Report

How to file vat return? You must file for tax return electronically through the fta portal: Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Filing vat returns on time is essential for ensuring compliance and avoiding penalties.

How to file VAT Return in UAE how to file VAT return on Emara tax

Filing vat returns on time is essential for ensuring compliance and avoiding penalties. Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. How to file vat return? You must file for tax return electronically through the fta portal:

UAE VAT Return Filing Comprehensive Guide For 2025

You must file for tax return electronically through the fta portal: Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. How to file vat return? Filing vat returns on time is essential for ensuring compliance and avoiding penalties.

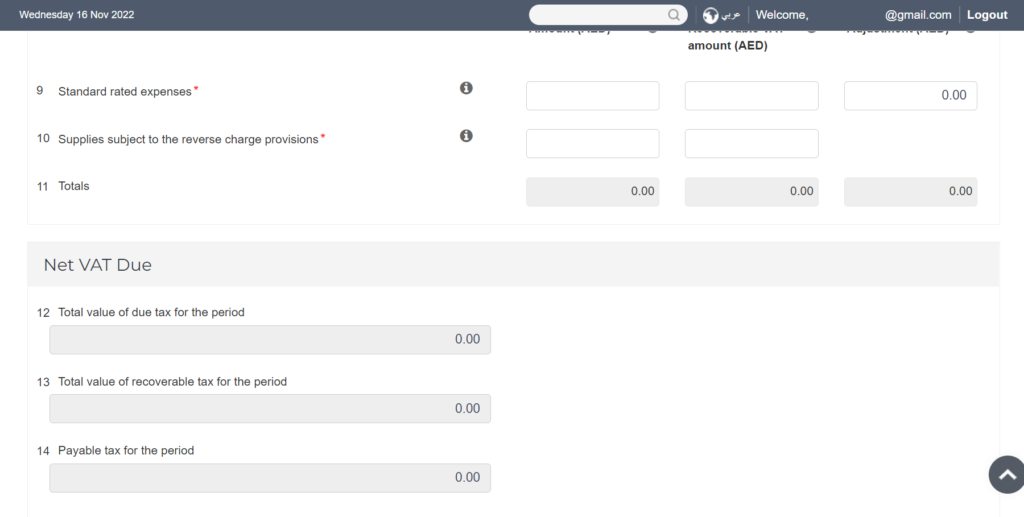

Demystifying VAT Return Form 201 A Guide for UAE Businesses

Filing vat returns on time is essential for ensuring compliance and avoiding penalties. You must file for tax return electronically through the fta portal: Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. How to file vat return?

PPT Vat Return Filing In UAE PowerPoint Presentation, free download

You must file for tax return electronically through the fta portal: How to file vat return? Filing vat returns on time is essential for ensuring compliance and avoiding penalties. Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations.

StepbyStep Guide to Filing VAT Return in UAE

How to file vat return? Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. You must file for tax return electronically through the fta portal: Filing vat returns on time is essential for ensuring compliance and avoiding penalties.

How to File VAT Returns in UAE? A stepbystep VAT Returns User Guide

How to file vat return? Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Filing vat returns on time is essential for ensuring compliance and avoiding penalties. You must file for tax return electronically through the fta portal:

A StepByStep Guide On VAT Filing in UAE Tulpar Global Taxation

Filing vat returns on time is essential for ensuring compliance and avoiding penalties. How to file vat return? You must file for tax return electronically through the fta portal: Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations.

Filing Vat Return in UAE Vat Return UAE How to file VAT Return in

Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. How to file vat return? Filing vat returns on time is essential for ensuring compliance and avoiding penalties. You must file for tax return electronically through the fta portal:

How To File Vat Return?

You must file for tax return electronically through the fta portal: Filing vat returns on time is essential for ensuring compliance and avoiding penalties. Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations.