Uae Vat Return Format - Businesses registered for vat in the uae must file vat returns for each tax period as prescribed by the federal tax authority.

Businesses registered for vat in the uae must file vat returns for each tax period as prescribed by the federal tax authority.

Businesses registered for vat in the uae must file vat returns for each tax period as prescribed by the federal tax authority.

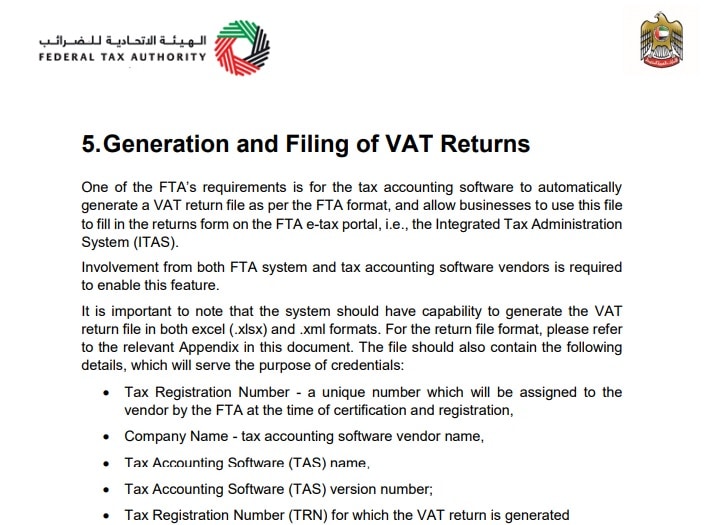

How to File VAT Returns in UAE? A stepbystep VAT Returns User Guide

Businesses registered for vat in the uae must file vat returns for each tax period as prescribed by the federal tax authority.

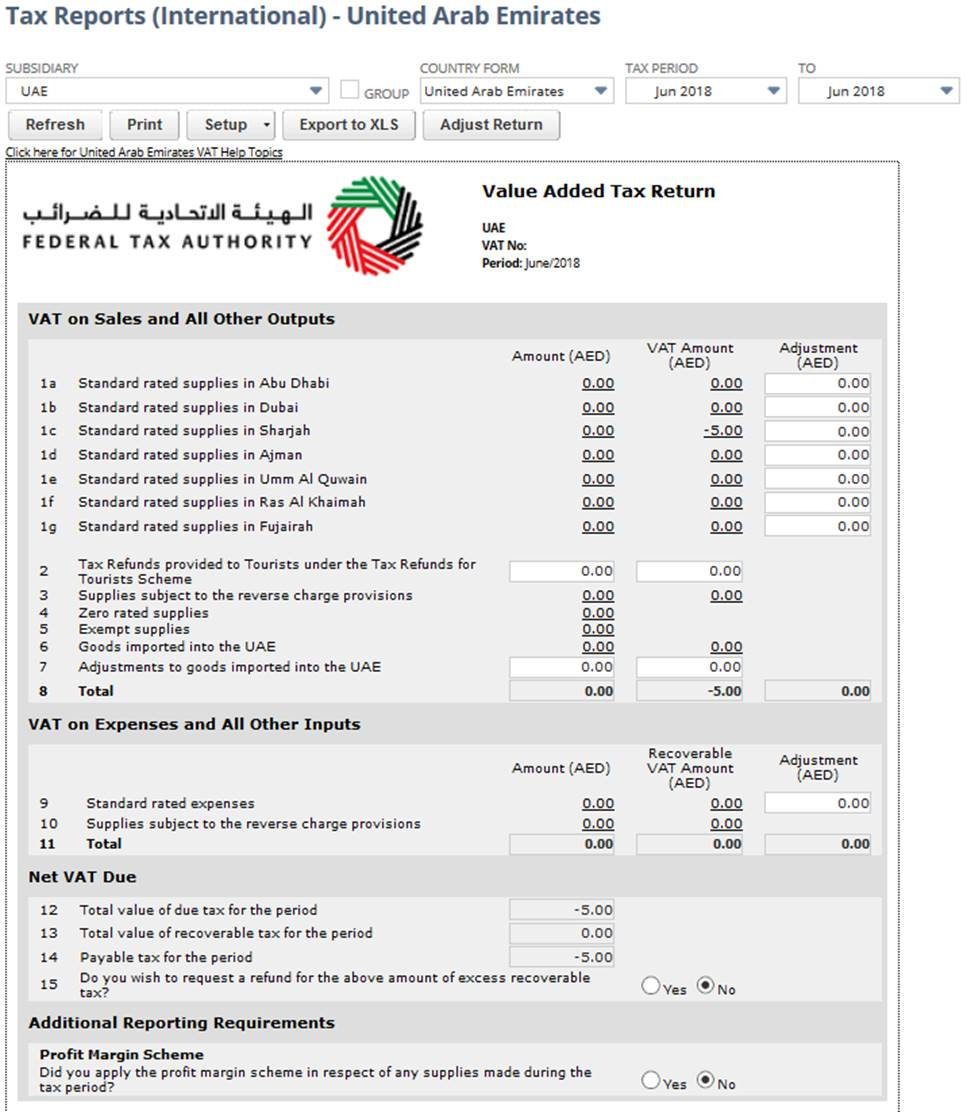

Demystifying VAT Return Form 201 A Guide for UAE Businesses

Businesses registered for vat in the uae must file vat returns for each tax period as prescribed by the federal tax authority.

VAT RETURN FORM All About TAX In UAE

Businesses registered for vat in the uae must file vat returns for each tax period as prescribed by the federal tax authority.

How to File VAT Returns in UAE? A stepbystep VAT Returns User Guide

Businesses registered for vat in the uae must file vat returns for each tax period as prescribed by the federal tax authority.

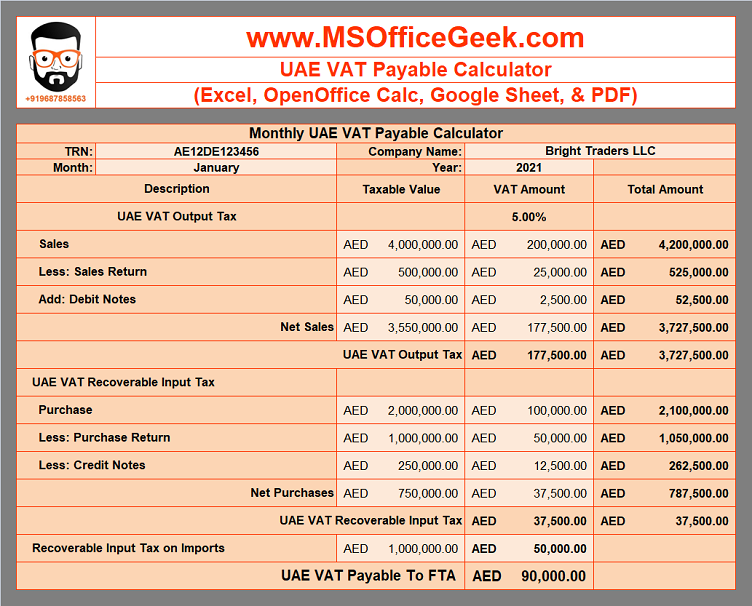

How to make UAE VAT Return format in MS Excel Calculate VAT in Excel

Businesses registered for vat in the uae must file vat returns for each tax period as prescribed by the federal tax authority.

How to File a VAT Return in the UAE

Businesses registered for vat in the uae must file vat returns for each tax period as prescribed by the federal tax authority.

ReadyToUse UAE VAT Payable Calculator Template MSOfficeGeek

Businesses registered for vat in the uae must file vat returns for each tax period as prescribed by the federal tax authority.

How to File VAT Return in UAE New EMARA TAX PORTAL YouTube

Businesses registered for vat in the uae must file vat returns for each tax period as prescribed by the federal tax authority.

How To De Register Vat In The Uae Articles vrogue.co

Businesses registered for vat in the uae must file vat returns for each tax period as prescribed by the federal tax authority.