Vat Full Information In Uae - This page provides general information on value added tax that was introduced in january 2018 (at a rate of 5%), its role in effective fiscal. Find out in this section. Complete guide to vat compliance for uae businesses: Assistance with the more likely questions that. Learn about the 5% vat. An overview of the main vat rules and procedures in the uae and how to comply with them; What is vat, and how to register for it? Understanding the vat framework is. How to file vat returns and how can tourists seek refund? The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018.

Find out in this section. Understanding the vat framework is. Assistance with the more likely questions that. Complete guide to vat compliance for uae businesses: How to file vat returns and how can tourists seek refund? What is vat, and how to register for it? An overview of the main vat rules and procedures in the uae and how to comply with them; Learn about the 5% vat. The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. This page provides general information on value added tax that was introduced in january 2018 (at a rate of 5%), its role in effective fiscal.

The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. Find out in this section. Assistance with the more likely questions that. What is vat, and how to register for it? How to file vat returns and how can tourists seek refund? This page provides general information on value added tax that was introduced in january 2018 (at a rate of 5%), its role in effective fiscal. Understanding the vat framework is. An overview of the main vat rules and procedures in the uae and how to comply with them; Learn about the 5% vat. Complete guide to vat compliance for uae businesses:

Full details about the VAT refund available in the UAE

Complete guide to vat compliance for uae businesses: Find out in this section. An overview of the main vat rules and procedures in the uae and how to comply with them; The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. Learn about the 5% vat.

Key Points of VAT in UAE for Businesses

Complete guide to vat compliance for uae businesses: How to file vat returns and how can tourists seek refund? This page provides general information on value added tax that was introduced in january 2018 (at a rate of 5%), its role in effective fiscal. Find out in this section. What is vat, and how to register for it?

How To Print Your VAT Certificate In The UAE

Assistance with the more likely questions that. Understanding the vat framework is. Complete guide to vat compliance for uae businesses: Find out in this section. An overview of the main vat rules and procedures in the uae and how to comply with them;

A COMPREHENSIVE GUIDE ON UAE VALUE ADDED TAX UAE VAT SIMPLIFIED by CA

The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. Learn about the 5% vat. This page provides general information on value added tax that was introduced in january 2018 (at a rate of 5%), its role in effective fiscal. Assistance with the more likely questions that. An overview of the main vat rules.

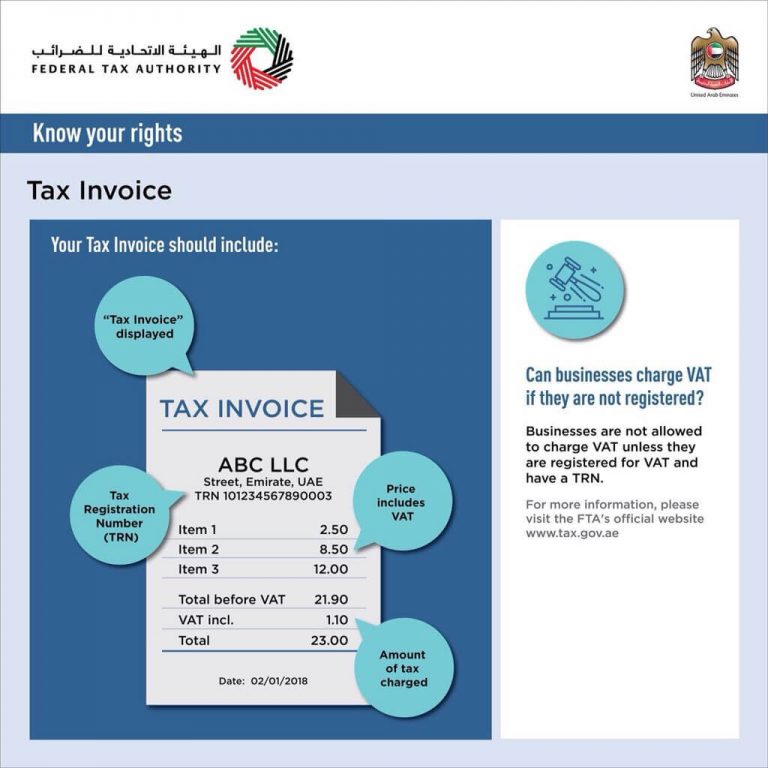

VAT Invoice Format in UAE FTA Tax Invoice Format UAE

Find out in this section. Understanding the vat framework is. This page provides general information on value added tax that was introduced in january 2018 (at a rate of 5%), its role in effective fiscal. Complete guide to vat compliance for uae businesses: The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018.

How to Prepare VAT Invoice in UAE? (100 Accuracy)

The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. Complete guide to vat compliance for uae businesses: How to file vat returns and how can tourists seek refund? Understanding the vat framework is. This page provides general information on value added tax that was introduced in january 2018 (at a rate of 5%),.

VAT in UAE 2024 Federal Tax Authority Everything You Need about

An overview of the main vat rules and procedures in the uae and how to comply with them; The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. Find out in this section. How to file vat returns and how can tourists seek refund? Assistance with the more likely questions that.

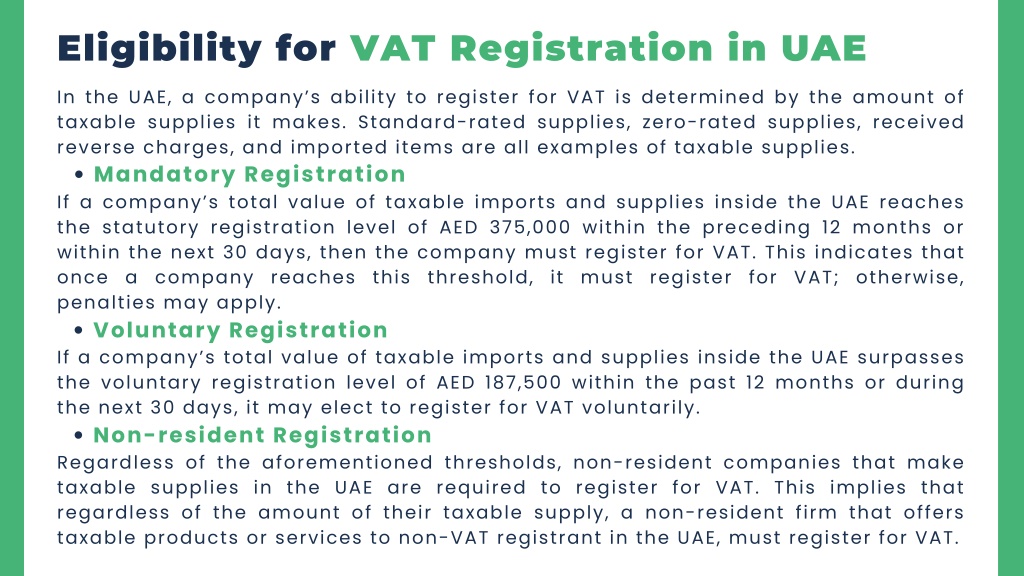

PPT VAT Registration in UAE PowerPoint Presentation, free download

How to file vat returns and how can tourists seek refund? Assistance with the more likely questions that. The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. Find out in this section. Learn about the 5% vat.

PPT Documents required for vat registration in dubai PowerPoint

The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. Assistance with the more likely questions that. An overview of the main vat rules and procedures in the uae and how to comply with them; This page provides general information on value added tax that was introduced in january 2018 (at a rate of.

VAT Registration in UAE How to Register for VAT in UAE, How to Apply

How to file vat returns and how can tourists seek refund? Find out in this section. The members of the gulf corporation council (gcc) introduced vat across the uae in january 2018. Learn about the 5% vat. What is vat, and how to register for it?

Assistance With The More Likely Questions That.

How to file vat returns and how can tourists seek refund? An overview of the main vat rules and procedures in the uae and how to comply with them; Understanding the vat framework is. This page provides general information on value added tax that was introduced in january 2018 (at a rate of 5%), its role in effective fiscal.

The Members Of The Gulf Corporation Council (Gcc) Introduced Vat Across The Uae In January 2018.

Complete guide to vat compliance for uae businesses: What is vat, and how to register for it? Find out in this section. Learn about the 5% vat.