Vat Laws In Uae - The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. The person residing in uae or in an vat implementing state is obligated to register under the decree la. Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value. For the arab states of the. All countries that are full members of the cooperation council. Liable to register for vat? Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that.

Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that. Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value. The person residing in uae or in an vat implementing state is obligated to register under the decree la. All countries that are full members of the cooperation council. The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. Liable to register for vat? For the arab states of the. Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made.

Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value. All countries that are full members of the cooperation council. Liable to register for vat? The person residing in uae or in an vat implementing state is obligated to register under the decree la. For the arab states of the. Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that. The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made.

UAE VAT Law Key Updates and Expert Advice 2023

The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. The person residing in uae or in an vat implementing state is obligated to register under the decree la. For the arab states of the. Vat is levied on the supply of all goods and services, including.

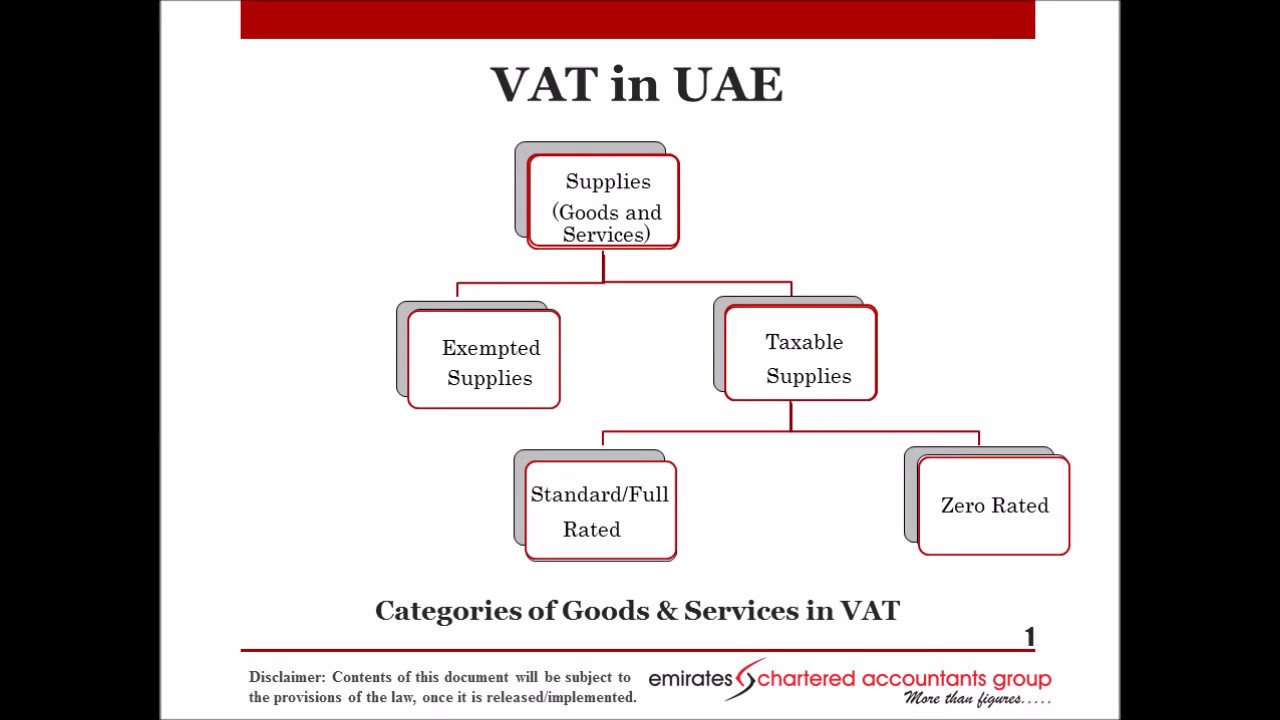

New UAE VAT rules Exemptions for businesses and registration for the 5

The person residing in uae or in an vat implementing state is obligated to register under the decree la. All countries that are full members of the cooperation council. Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. Value added tax (vat) everything you need.

A COMPREHENSIVE GUIDE ON UAE VALUE ADDED TAX UAE VAT SIMPLIFIED by CA

The person residing in uae or in an vat implementing state is obligated to register under the decree la. The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. Value added tax (vat) everything you need to know about vat implementation in the uae this page provides.

VAT law in UAE Explained FINTAXCA YouTube

Liable to register for vat? The person residing in uae or in an vat implementing state is obligated to register under the decree la. The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. Anyone excepted from tax registration according to clause (1) of this article shall.

A Guide to New Amendments to UAE VAT Decree Law

The person residing in uae or in an vat implementing state is obligated to register under the decree la. Liable to register for vat? All countries that are full members of the cooperation council. Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value. The uae government decided.

UAE announces changes to VAT provisions (Updated) BMS

Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. The person residing in uae or in an vat implementing state is obligated.

Comprehensive List of UAE VAT Law Changes in 2023

The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. Liable to register for vat? For the arab states of the. Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. The person.

Derecho Constitucional Suaed UNAM, 42 OFF

All countries that are full members of the cooperation council. Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that. Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. The person residing.

Statute of Limitations Under the Amended UAE VAT Law

The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. All countries that are full members of the cooperation council. Liable to register.

New VAT Rules in UAE (2023) RSN Finance Accounting Company

Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that. Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. The uae government decided to diversify its economy and sources of income beyond.

Value Added Tax (Vat) Everything You Need To Know About Vat Implementation In The Uae This Page Provides General Information On Value.

Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that. The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. For the arab states of the.

The Person Residing In Uae Or In An Vat Implementing State Is Obligated To Register Under The Decree La.

Liable to register for vat? All countries that are full members of the cooperation council.