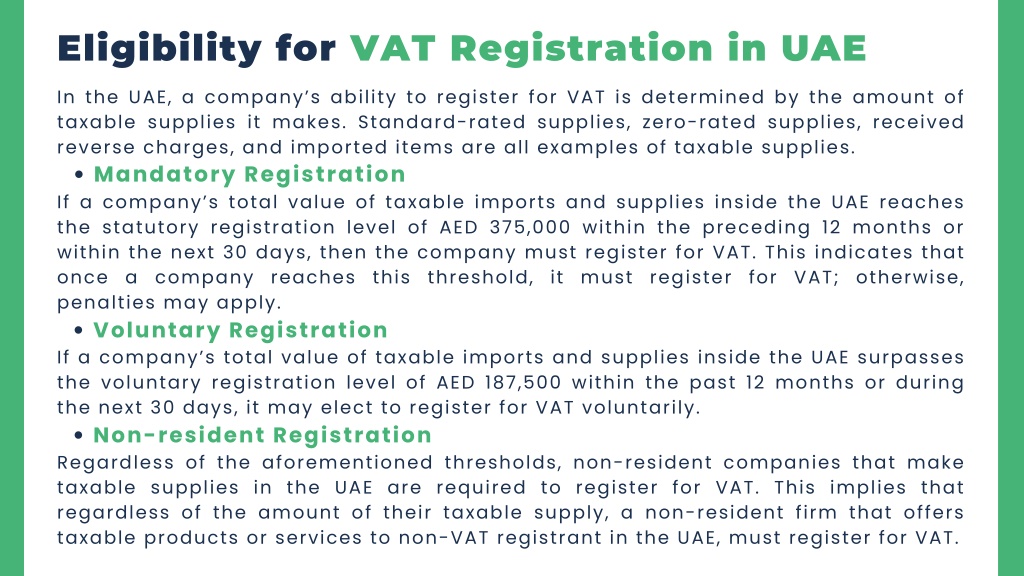

Vat Registration Criteria In Uae - Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. Come and review the facts about those who can apply for vat registration. It is mandatory for businesses to register for vat in the following two cases: A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. According to tax legislation, a company’s proprietors must proceed with uae. In the uae, the mandatory vat registration level is aed 375,000. Understand who needs to register,.

Come and review the facts about those who can apply for vat registration. According to tax legislation, a company’s proprietors must proceed with uae. In the uae, the mandatory vat registration level is aed 375,000. Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. Understand who needs to register,. It is mandatory for businesses to register for vat in the following two cases:

In the uae, the mandatory vat registration level is aed 375,000. Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. Come and review the facts about those who can apply for vat registration. Understand who needs to register,. It is mandatory for businesses to register for vat in the following two cases: According to tax legislation, a company’s proprietors must proceed with uae. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed.

PPT Documents required for vat registration in dubai PowerPoint

Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. It is mandatory for businesses to register for vat in the following two cases: In the uae, the mandatory vat registration level.

Who Needs to Register for VAT in the UAE? Key Criteria Explained

Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. Understand who needs to register,. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. It is mandatory for businesses to register for vat in the following two cases: In the uae,.

PPT Understanding the Latest VAT Registration Requirements in the UAE

In the uae, the mandatory vat registration level is aed 375,000. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. Come and review the facts about those who can apply for vat registration. It is mandatory for businesses to register for vat in the following two cases: According to tax.

Apply For VAT Registration in UAE Tulpar Team is Here To Help

A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. According to tax legislation, a company’s proprietors must proceed with uae. Understand who needs to register,. It is mandatory for businesses to register for vat in the following two cases: Uae businesses must register for vat if their taxable supplies and.

Importance of VAT Registration in UAE

A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. It is mandatory for businesses to register for vat in the following two cases: Come and review the facts about those who can apply for vat registration. According to tax legislation, a company’s proprietors must proceed with uae. Understand who needs.

VAT Registration Requirements in UAE ALNABAHA CONSULTANCIES

In the uae, the mandatory vat registration level is aed 375,000. Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. It is mandatory for businesses to register for vat in the.

VAT Registration Criteria for Different Business Types

A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. Understand who needs to register,. Come and review the facts about those who can apply for vat registration. In the uae, the mandatory vat registration level is aed 375,000. According to tax legislation, a company’s proprietors must proceed with uae.

Comprehensive Guide UAE VAT Registration Criteria

Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. In the uae, the mandatory vat registration level is aed 375,000. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. It is mandatory for businesses to register for vat in the.

Corporate Tax In The UAE Everything You Need To Know

It is mandatory for businesses to register for vat in the following two cases: According to tax legislation, a company’s proprietors must proceed with uae. Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. A business must register for vat if the taxable supplies and imports exceed the mandatory registration.

PPT VAT Registration in UAE PowerPoint Presentation, free download

Understand who needs to register,. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. According to tax legislation, a company’s proprietors must proceed with uae. Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. It is mandatory for businesses to.

Uae Businesses Must Register For Vat If Their Taxable Supplies And Imports Exceed Aed 375,000 Annually (Aed 187,500 For.

Come and review the facts about those who can apply for vat registration. According to tax legislation, a company’s proprietors must proceed with uae. In the uae, the mandatory vat registration level is aed 375,000. Understand who needs to register,.

A Business Must Register For Vat If The Taxable Supplies And Imports Exceed The Mandatory Registration Threshold Of Aed.

It is mandatory for businesses to register for vat in the following two cases: